对财务报表舞弊的思考

10页1、外文文献翻译原文:Consideration of Fraud in a Financial Statement AuditDescription and Characteristics of FraudFraud is a broad legal concept and auditors do not make legal determinations of whether fraud has occurred. Rather, the auditors interest specifically relates to acts that result in a material misstatement of the financial statements. The primary factor that distinguishes fraud from error is whether the underlying action that results in the misstatement of the financial statements is intentional

2、 or unintentional. For purposes of the Statement, fraud is an intentional act that results in a material misstatement in financial statements that are the subject of an audit.Intent is often difficult to determine, particularly in matters involving accounting estimates and the application of accounting principles. For example, unreasonable accounting estimates may be unintentional or may be the result of an intentional attempt to misstate the financial statements. Although an audit is not design

3、ed to determine intent, the auditor has a responsibility to plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether the misstatement is intentional or not.Two types of misstatements are relevant to the auditors consideration of fraud misstatements arising from fraudulent financial reporting and misstatements arising from misappropriation of assets.1、Misstatements arising from fraudulent financial reporting are in

4、tentional misstatements or omissions of amounts or disclosures in financial statements designed to deceive financial statement users where the effect causes the financial statements not to be presented, in all material respects, in conformity with generally accepted accounting principles (GAAP). Fraudulent financial reporting may be accomplished by the following:(1) Manipulation, falsification, or alteration of accounting records or supporting documents from which financial statements are prepar

《对财务报表舞弊的思考》由会员桔****分享,可在线阅读,更多相关《对财务报表舞弊的思考》请在金锄头文库上搜索。

就职新人求职英文自我介绍范文

【精选汇编】2022内科护理部门工作总结

校园周边环境治理方案

2023年春季幼儿园教学工作计划标准范本(3篇).doc

学校实验室2022年9月工作总结

学习窦铁成同志先进事迹心得体会

九年级数学下册教学计划

今天_我们怎样做教育

毕业设计论文固定型气体驱动射流泵采油装置设计

公司价值评估方法

参加学校综合实践活动培训的个人体会.doc

如何发挥生字卡片的多功能作用论文

005成飞集团室经理(主任)KPI表

初中英语知识归纳总结材料大全

网络营销效果衡量的核心指标

形考一理解上网行为管理系统软件地功能

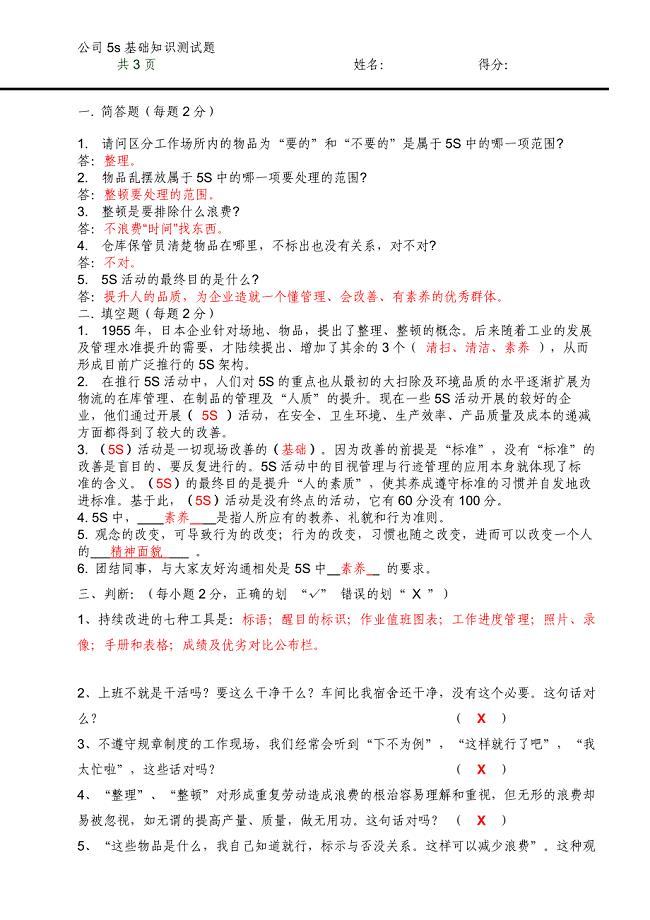

5s基础知识测试题答案

建筑公司下半年工作计划样本(五篇).doc

2023年初一数学集备组计划

2022毕业晚会策划书5篇优秀范文

数量性状的遗传分析

数量性状的遗传分析

2024-01-06 17页

医院人事科科长绩效考核指标

医院人事科科长绩效考核指标

2023-09-08 18页

产后抑郁症知识手册

产后抑郁症知识手册

2022-09-05 11页

2021年七夕节活动策划方案

2021年七夕节活动策划方案

2024-01-04 17页

公安基础知识复习笔记

公安基础知识复习笔记

2022-08-11 9页

首都师范大学教育学考研历年考题

首都师范大学教育学考研历年考题

2022-09-30 26页

酯化反应催化剂

酯化反应催化剂

2023-06-01 2页

教师读书心得体会5篇

教师读书心得体会5篇

2023-08-23 12页

消防演练流程及任务

消防演练流程及任务

2023-09-16 2页

武夷茶道营销策划书

武夷茶道营销策划书

2023-01-20 10页