专业英语八级阅读理解十六

14页1、专业英语八级 -阅读理解 (十六)( 总分: 100.00 ,做题时间: 90 分钟 )一、BREADING COMPREHENSION/B( 总题数: 0,分数: 0.00)二、BTEXT A/B( 总题数: 1,分数: 25.00)Of all the lessons taught by the financial crisis, themost personal hasbeen that Americans arent too slick with money. We take out home loans we cant afford. Werun up sky-high credit-card debt. Wedont save nearly enough for retirement.In response, proponents of financial-literacy education are stumping with renewed zeal. School districts in states such as NewJersey and Illinois a

2、re adding money-management courses to their curriculums. The Treasury and Education departments are sending lesson plans to high schools and encouraging students to compete in the National Financial Capability Challenge that begins in March.Students with top scores on that exam will receive certificates butchances for long- term benefits are slim. As it turns out, there is little evidence that traditional efforts to boost financial know-how help students make better decisions outside the classro

3、om. Even as the financial-literacymovementhas gained steam over the past decade, scoreshave been falling on tests that measure how savvy students are about things such as budgeting, credit cards, insurance and investments.We need to figure out how to do this the right way, says Lewis Mandell, a professor at the University of Washington who after 15 years of studying financial-literacy programs has come to the conclusion that current methods dont work. A growing number of researchers and educator

4、s agree that a more radical approach is needed. They advocate starting financial education a lot earlier than high school, putting real moneyand spending decisions into kids hands and talking openly about the emotions and social influences tied to how we spend.Other initiatives are tackling such real-world issues as the commercial and social pressures that affect purchasing decisions. Whyexactly do you want those expensive name-brand sneakers so badly? It takes confidence to take a stand and to

《专业英语八级阅读理解十六》由会员鲁**分享,可在线阅读,更多相关《专业英语八级阅读理解十六》请在金锄头文库上搜索。

基于MNM-GARCH模型的沪深股市动态关联性研究

金银花品种的本草考证

大连理工大学22春《电气工程概论》离线作业二及答案参考27

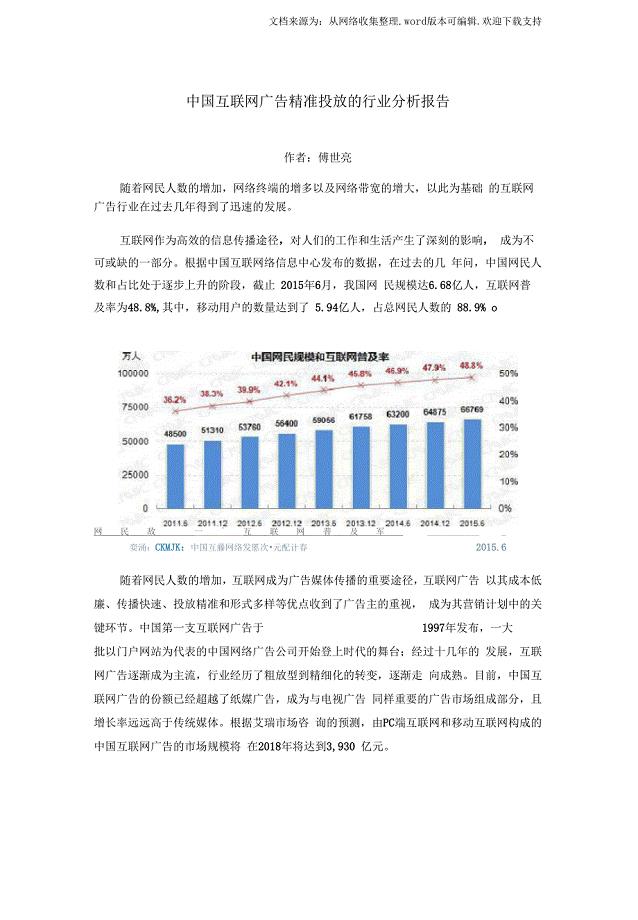

中国互联网广告精准投放的行业分析报告

某集中式农村安全饮水工程施工组织设计

2023小区物业保洁年终个人总结(2篇).doc

学生会部门工作总结格式

地质灾难监测宣传工作意见

2022年来料加工合同范本

有关旗下讲话演讲稿模板5篇

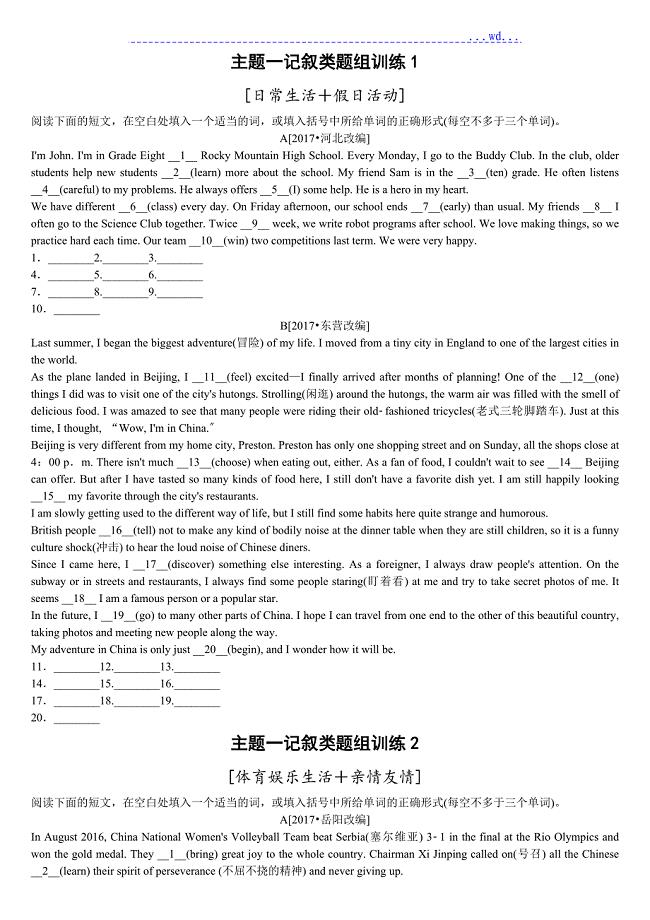

2018中考英语浙江复习专练三语法填空

儿科医生个人总结五篇

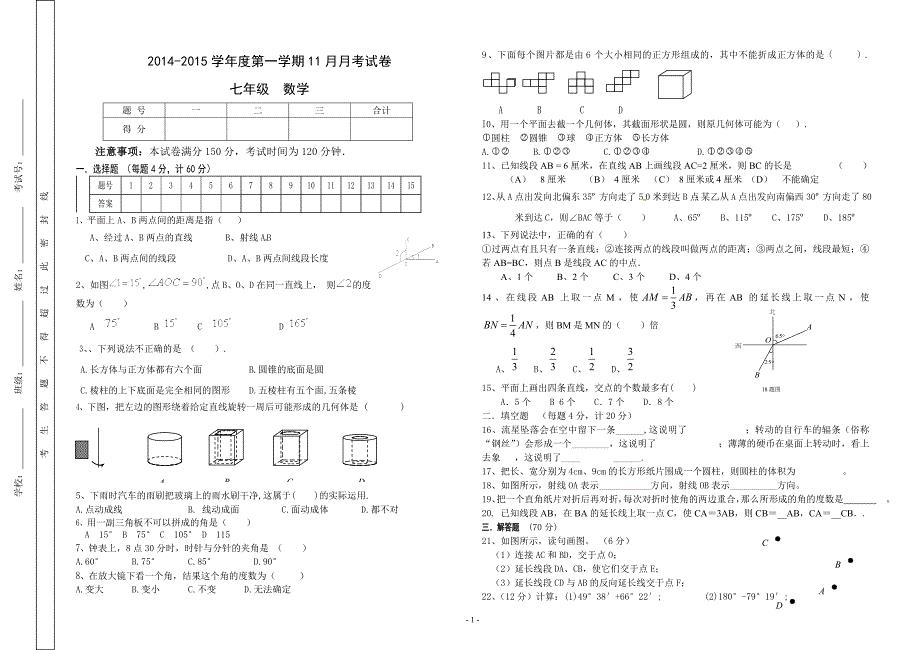

北师大七上11月月考考试

养成好习惯心得体会

高新行业营销策划书范文

检测试验费该谁出定稿版

大学生毕业总结(4篇).doc

2023学校教研年终考核工作总结(3篇).doc

小学数学三年级下册教案-《24时计时法》教学设计4

加油站安全生产事故应急救援预案

丹毒护理常规

丹毒护理常规

2023-03-24 5页

人体运动功能和肌肉损伤文字附图

人体运动功能和肌肉损伤文字附图

2023-02-05 15页

小学数学人教版三年级上册倍的认识同步练习

小学数学人教版三年级上册倍的认识同步练习

2023-01-31 3页

基于MATLAB的数字图像与边缘检测毕业论文

基于MATLAB的数字图像与边缘检测毕业论文

2024-01-16 37页

2022年证券一般从业考前难点冲刺押题卷含答案155

2022年证券一般从业考前难点冲刺押题卷含答案155

2022-08-07 146页

房地长开发项目全程策划方案设计论文

房地长开发项目全程策划方案设计论文

2022-10-31 76页

2022~2023电信职业技能鉴定考试题库及满分答案881

2022~2023电信职业技能鉴定考试题库及满分答案881

2023-02-06 16页

p墙体、墙垛、马牙槎、内墙、施工流程

p墙体、墙垛、马牙槎、内墙、施工流程

2022-10-03 12页

高二英语期中考试阅读理解题汇编下册

高二英语期中考试阅读理解题汇编下册

2023-03-01 33页

营运司机个人简历范文

营运司机个人简历范文

2023-05-16 9页