套利定价理论与多因素模型

18页1、CHAPTER 10,Arbitrage Pricing Theory and Multifactor Models of Risk and Return 套利定价理论与多因素模型,Single Factor Model单因素模型,Returns on a security come from two sources 证券收益有两大源泉 Common macro-economic factor 公共宏观经济因素 Firm specific events 公司特有事件 Possible common macro-economic factors 可能的公共宏观经济因素 Gross Domestic Product Growth 国内生产总值的增长 Interest Rates 利率,Single Factor Model Equation单因素模型公式,ri = Return for security I = Factor sensitivity or factor loading or factor beta F = Surprise in macro-economic factor

2、(F could be positive, negative or zero) ei = Firm specific events,Multifactor Models多因素模型,Use more than one factor in addition to market return 除市场收益外,不止使用一个因素 Examples include gross domestic product, expected inflation, interest rates etc. 例子包括国内生产总值,期望的通货膨胀,利率等 Estimate a beta or factor loading for each factor using multiple regression. 使用多元回归去估计一个贝塔值或每个因素的因子载荷,Multifactor Model Equation多因素模型公式,ri = E(ri) + GDP GDP + IR IR + ei ri = Return for security i GDP= Factor sensitivity for GDP IR = Fa

3、ctor sensitivity for Interest Rate ei = Firm specific events,Multifactor SML Models多因素证券市场线的模型,E(r) = rf + GDPRPGDP + IRRPIR GDP = Factor sensitivity for GDP RPGDP = Risk premium for GDP IR = Factor sensitivity for Interest Rate RPIR = Risk premium for Interest Rate,Arbitrage Pricing Theory套利定价理论,Arbitrage - arises if an investor can construct a zero investment portfolio with a sure profit 套利-通过零投资组合而获得无风险利润 Since no investment is required, an investor can create large positions to secure large

4、levels of profit 由于没有投资是必需的,投资者可以构建大量的投资组合以确保大的利润水平 In efficient markets, profitable arbitrage opportunities will quickly disappear 在有效市场中,这种套利机会会迅速消失,APT & Well-Diversified Portfolios套利定价理论及充分分散的投资组合,rP = E (rP) + bPF + eP F = some factor For a well-diversified portfolio: eP approaches zero Similar to CAPM,Figure 10.1 Returns as a Function of the Systematic Factor作为系统因素函数的收益,Figure 10.2 Returns as a Function of the Systematic Factor: An Arbitrage Opportunity出现了套利机会,Figure 10.3 An Arbitrage Oppo

《套利定价理论与多因素模型》由会员灯火****19分享,可在线阅读,更多相关《套利定价理论与多因素模型》请在金锄头文库上搜索。

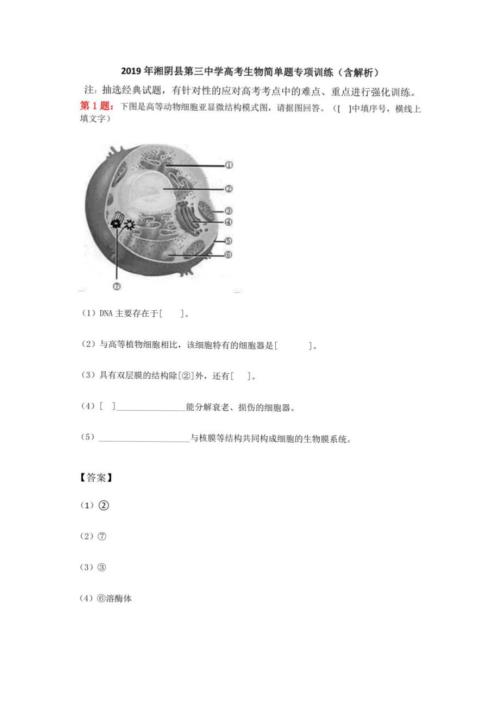

2019年湘阴县第三中学高考生物简单题专项训练(含解析)

2019年耿马县民族中学高考生物简单题专项训练(含解析)

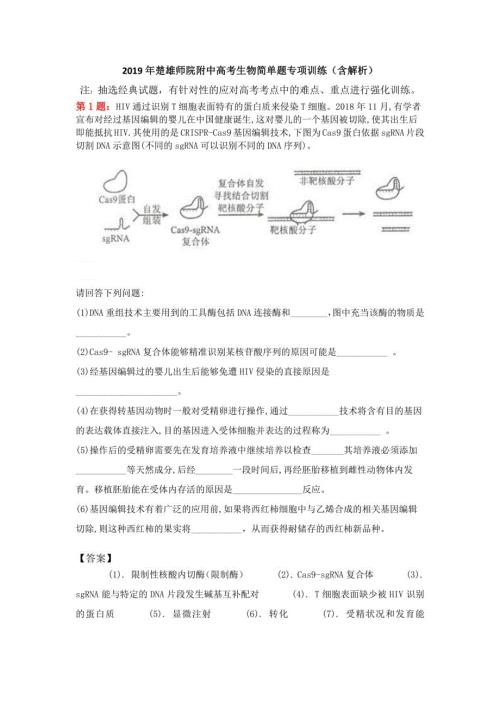

2019年楚雄师院附中高考生物简单题专项训练(含解析)

2019年桥梁工程师年终总结

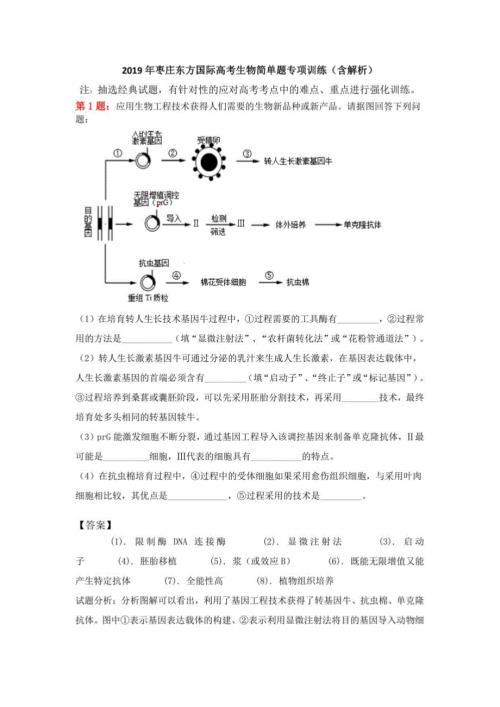

2019年枣庄东方国际高考生物简单题专项训练(含解析)

2018年一级建造师公路工程实务考点归纳

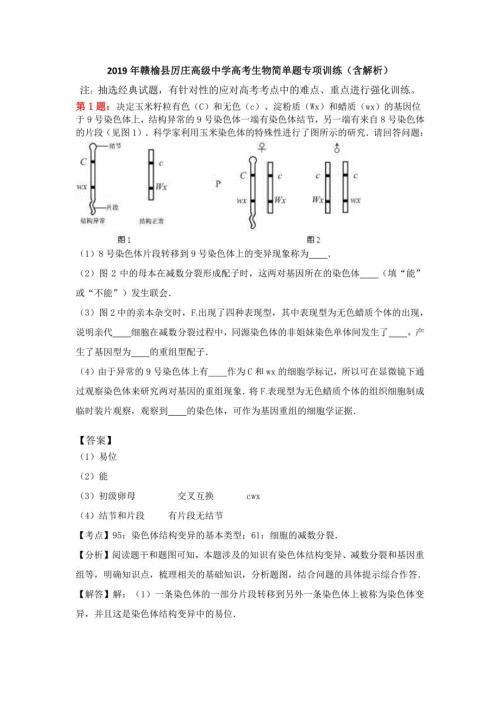

2019年赣榆县高考生物简单题专项训练(含解析)

2019年春湾中学高考生物简单题专项训练(含解析)

高考地理复习汇总

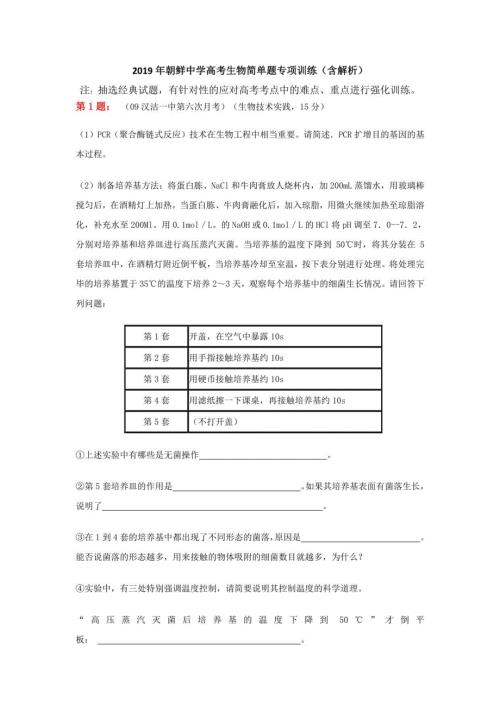

2019年朝鲜中学高考生物简单题专项训练(含解析)

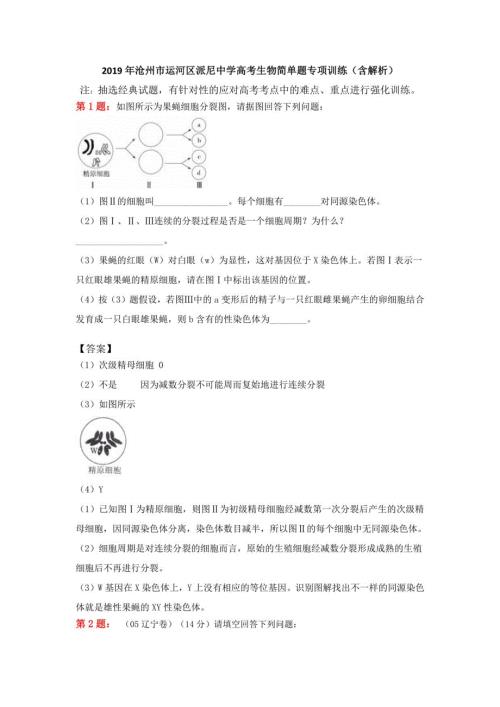

2019年沧州市运河区派尼中学高考生物简单题专项训练(含解析)

2018年甘肃公务员《行政职业能力测验》试题(网友回忆版)

宾语从句 (解析卷)---2023年中考英语考点详解+专项训练

2018年一级建造师通信与广电实务考点

2019年湖北省襄阳市中考数学试卷(解析版)

文言文阅读(解析版)

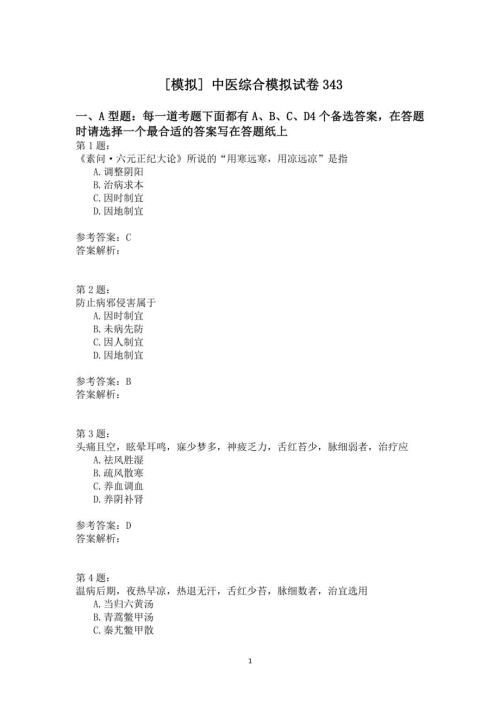

中医综合模拟试卷343

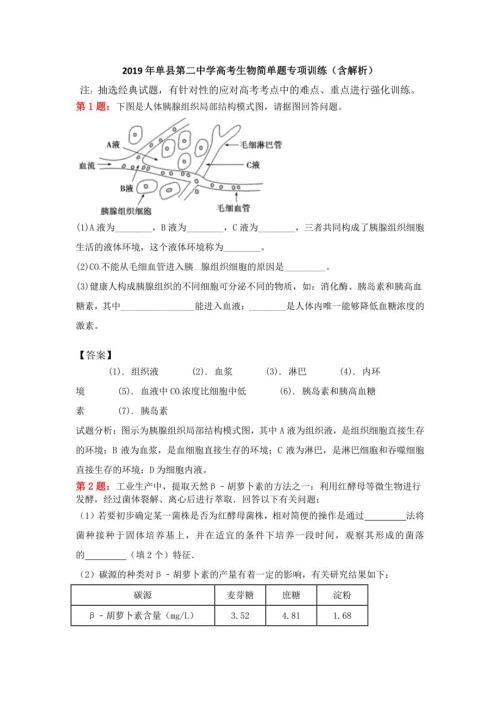

2019年单县第二中学高考生物简单题专项训练(含解析)

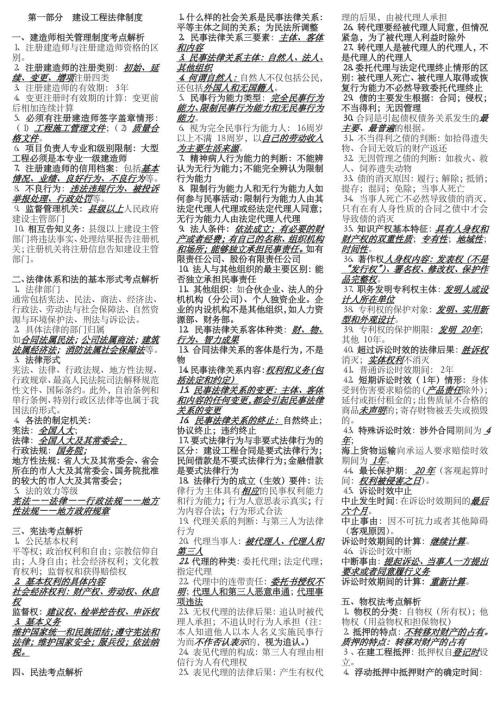

二级法规考点解析1

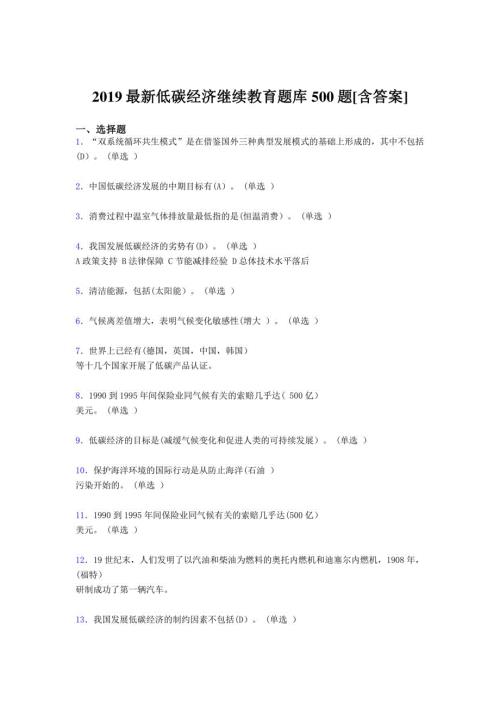

2019年低碳经济继续教育模拟考试题库500题(含标准答案)

多路复用技术介绍分析电气工程专业

多路复用技术介绍分析电气工程专业

2021-12-06 59页

脑卒中康复现状—康复治疗与研究热点

脑卒中康复现状—康复治疗与研究热点

2021-02-23 56页

师大附幼家园合作现状的调查与研究

师大附幼家园合作现状的调查与研究

2021-02-23 21页

食品分析《食品酸度的测定》 (第5章

食品分析《食品酸度的测定》 (第5章

2021-02-18 46页

考点一 实验探究酵母菌细胞呼吸的方式

考点一 实验探究酵母菌细胞呼吸的方式

2021-02-18 14页

版式设计与印刷

版式设计与印刷

2021-02-18 39页

技术差距论

技术差距论

2021-02-18 20页

广亩城市理论介绍

广亩城市理论介绍

2021-02-18 26页

学习选取议论的角度

学习选取议论的角度

2021-02-18 10页