Logistics Rate Outlook

5页1、2011 Logistics Rate Outlook - Going Up!Volatile oil and diesel prices, capacity shortages, another looming driver crisis, debilitating regulatory uncertainties, and an improving economy have lead industry analysts across all modes to one conclusion: Shippers will have to shoulder some of the burden associated with escalating transportation costs this year.By Patrick Burnson, Executive EditorJanuary 24, 2011 The good news is that an economic recovery is clearly underway, with demand in goods and

2、services keeping pace with the modest predictions Logistics Management presented six months ago in our 2010 mid-year forecast. But many analysts say that the overall economic picture in 2011 will begin with a whimper rather than a roar.For shippers, this means tighter “spend management” when it comes to choosing modes and routing as theyll be called upon to shoulder some of the burden associated with escalating transportation costs this year.In its most recent survey, the National Association fo

3、r Business Economics (NABE) projects a sluggish start. “Projections for real GDP growth remain sub-par through the first quarter of 2011, but accelerate gradually through the forecast period,” says NABE President Richard Wobbekind, who also serves as associate dean of the Leeds School of Business at the University of Colorado. “For next year as a whole, GDP growth is expected to be moderate.” Wobbekind adds that factors restraining growth include ongoing balance sheet restructuring by consumers

4、and businesses, as well as a diminished contribution to GDP growth from inventory restocking and government stimulus. “Confidence in the expansions durability is intact, but NABE panelists remain concerned about high levels of federal debt, a continuing high level of unemployment, increased business regulation, and rising commodity prices,” he says.Due to an uptick in consumer confidence at the end of last year, the NABE panel made modest revisions to its economic growth predictions for 2010 and

《Logistics Rate Outlook》由会员鲁**分享,可在线阅读,更多相关《Logistics Rate Outlook》请在金锄头文库上搜索。

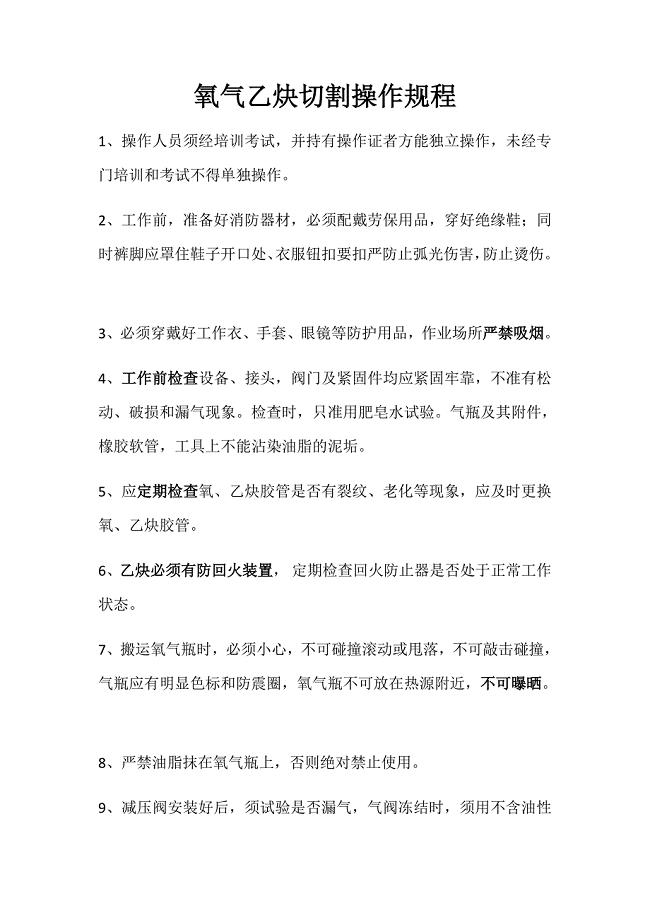

氧气乙炔切割操作规程

招聘计划书

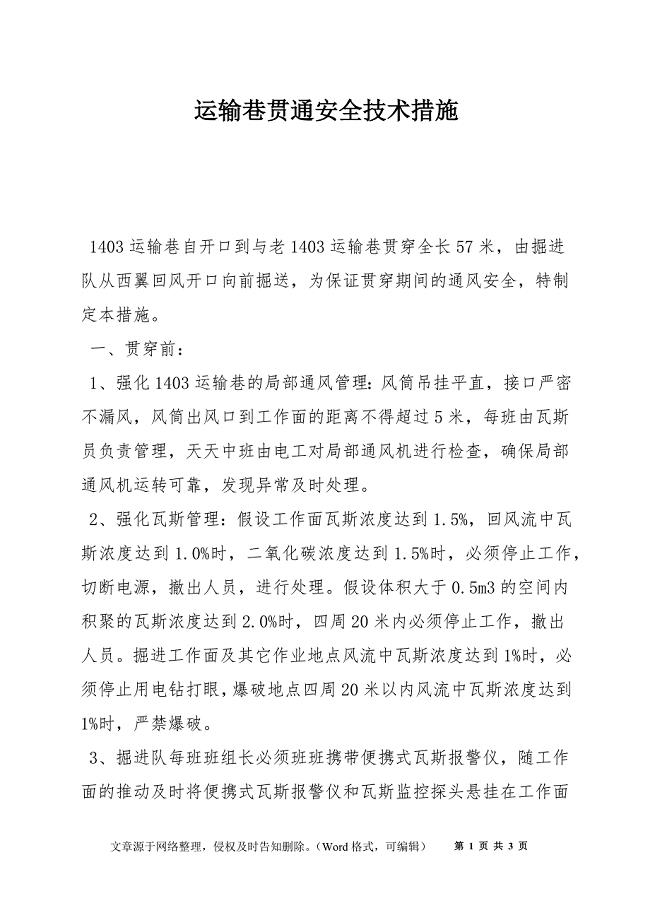

运输巷贯通安全技术措施

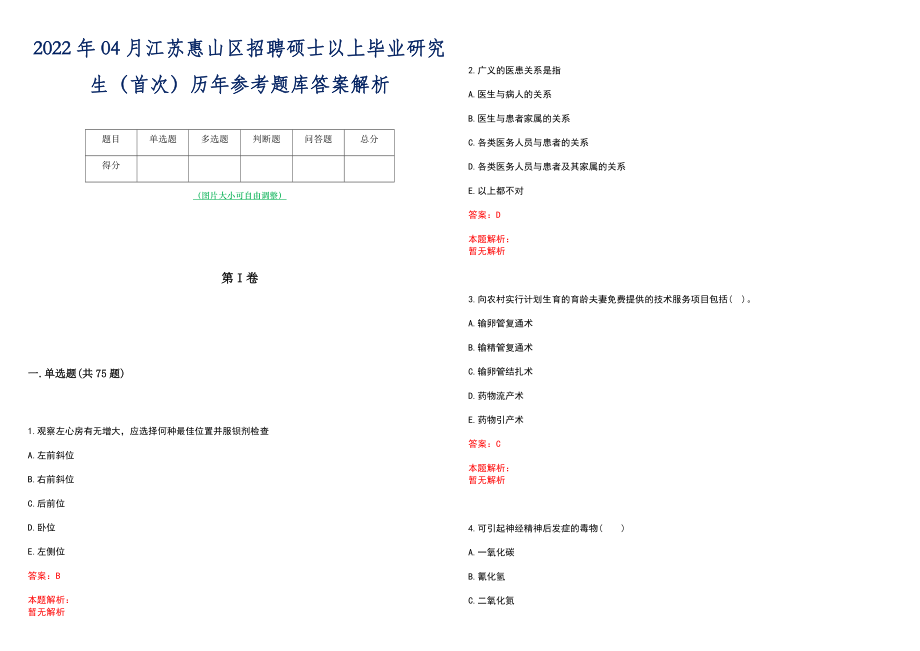

2022年04月江苏惠山区招聘硕士以上毕业研究生(首次)历年参考题库答案解析

公司部门工作总结范文2000字8篇

音乐是一种心境

某滑石有限公司质量管理手册

【新编】2023年班干部竞聘演讲稿

汽车4s店售后车间工作总结万能版7篇

2022年中级银行从业考试密押卷带答案159

七年级班主任工作总结参考版(20篇).doc

四川泸州市科技创新和人才发展中心引进急需紧缺人才1人补充模拟试卷【附答案解析】(第0套)

学中学七级(下)期末数学试卷两套汇编四附答案解析

护士长竞聘演讲稿3篇

景德镇烘培食品项目可行性研究报告(DOC 86页)

云南省危险化学品安全生产检测项目可研报告【范文模板】

2023年领导对员工的中节慰问信【精选】

2022教育硕士试题(难点和易错点剖析)附答案39

护理伦理学考点最终版 suda

奶茶店管理信息系统

家电销售工作总结(精选)

家电销售工作总结(精选)

2022-09-07 39页

07附录A:建设工程文件归档范围和保管期限表

07附录A:建设工程文件归档范围和保管期限表

2023-03-19 17页

单独夫妇信息核查工具(乡级版)使用说明

单独夫妇信息核查工具(乡级版)使用说明

2023-03-21 10页

2023科学教学工作计划 15篇

2023科学教学工作计划 15篇

2022-08-14 76页

2023精选主持人自我介绍范文集合九篇

2023精选主持人自我介绍范文集合九篇

2023-05-07 13页

小学生演讲稿汇编5篇

小学生演讲稿汇编5篇

2023-02-28 8页

2021我的未来演讲稿10篇

2021我的未来演讲稿10篇

2023-04-30 15页

创业计划集合6篇【最新】

创业计划集合6篇【最新】

2023-12-11 33页

【word版】2023年个人考核自我鉴定4篇

【word版】2023年个人考核自我鉴定4篇

2022-10-02 10页

音乐是一种心境

音乐是一种心境

2023-09-28 2页