公司理财第九版课后习题答案(英文Word)

474页1、Solutions ManualCorporate FinanceRoss, Westerfield, and Jaffe9th editionCHAPTER 1INTRODUCTION TO CORPORATEFINANCEAnswers to Concept Questions1. In the corporate form of ownership, the shareholders are the owners of the firm. The shareholders elect the directors of the corporation, who in turn appoint the firm s managemThis separation of ownership from control in the corporate form of organization is what causes agency problems to exist. Management may act in its own or someone else s besinterest

2、s, rather than those of the shareholders. If such events occur, they may contradict the goal of maximizing the share price of the equity of the firm.22. Such organizations frequently pursue social or political missions, so many different goals are conceivable. One goal that is often cited is revenue minimization; i.e., provide whatever goods and services are offered at the lowest possible cost to society. A better approach might be to observe that even a not-for-profit business has equity. Thus,

3、 one answer is that the appropriate goal is to maximize the value of the equity.3. Presumably, the current stock value reflects the risk, timing, and magnitude of all future cash flows, both short-term and long-term. If this is correct, then the statement is false.4. An argument can be made either way. At the one extreme, we could argue that in a market economy, all of these things are priced. There is thus an optimal level of, for example, ethical and/or illegal behavior, and the framework of s

4、tock valuation explicitly includes these. At the other extreme, we could argue that these are non-economic phenomena and are best handled through the political process. A classic (and highly relevant) thought question that illustrates this debate goes something like this: A firm has estimated that the cost of improving the safety of one of its products is $30 million. However, the firm believes that improving the safety of the product will only save $20 million in product liability claims. What

《公司理财第九版课后习题答案(英文Word)》由会员夏**分享,可在线阅读,更多相关《公司理财第九版课后习题答案(英文Word)》请在金锄头文库上搜索。

枝江市物流枢纽建设项目可行性研究报告模板参考

最美家庭先进事迹材料2篇

钻井常识200问

教师信息应用技术提升研修工作计划(2篇).doc

精品专题资料20222023年收藏广州市萝岗区东区二期规划十一路道路市政及配套工程招标公告

股权转让协议样书范文(二篇).doc

商品房装修合同电子版(九篇).doc

施工组织设计(北京市政二)

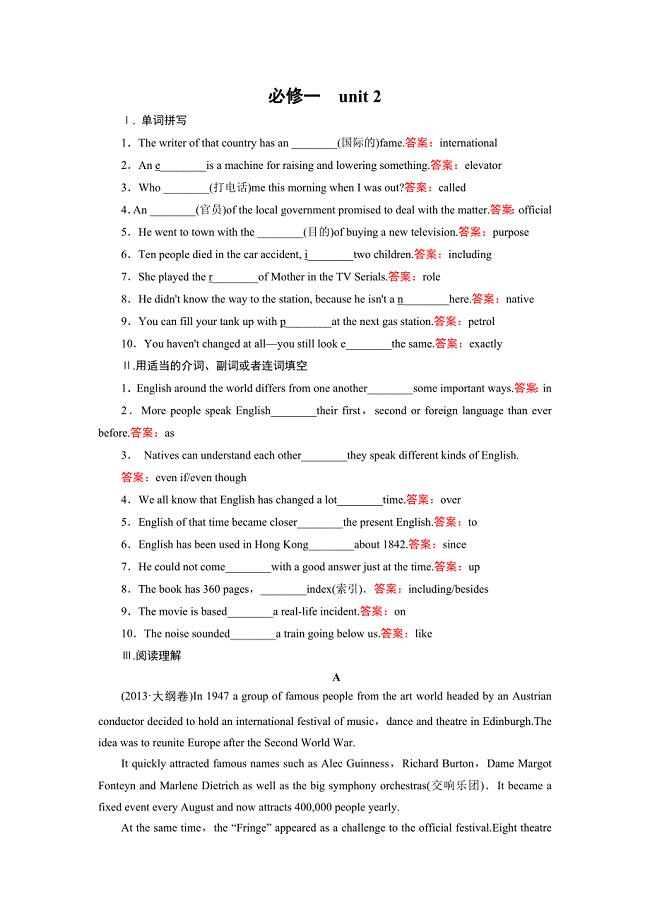

高考英语(人教版)一轮研精练必修1Unit2Englisharoundtheworld

校园三七女生节策划书.doc

2022年植树节国旗下演讲稿精选5篇范文

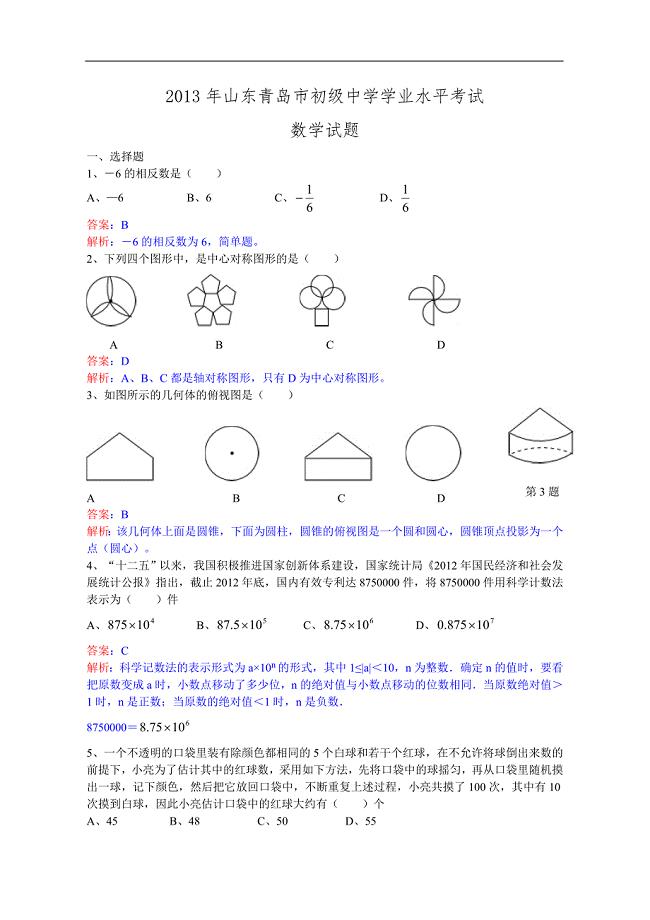

青岛市中考数学试卷及答案Word解析版

w上海城市道路平面交叉口规划与设计规程

计划生育个人工作计划范文(七篇).doc

农村初中美丽校园建设规划方案

定量包装机技术协议

地产置业顾问工作计划范本(四篇).doc

小学数学名师工作室学员个人学习计划

民用建设工程设计协议书律师版(四篇).doc

xx公寓安装工程监理细则(DOC 57页)

可再生能源与低碳社会答案有答案

可再生能源与低碳社会答案有答案

2023-08-30 7页

青海广播电视大学学生社会调查报告选题表.doc

青海广播电视大学学生社会调查报告选题表.doc

2023-04-06 7页

农村初中历史学困生的转化策略

农村初中历史学困生的转化策略

2023-12-07 3页

2017学校内部审计工作计划

2017学校内部审计工作计划

2023-04-26 7页

自然地理学英语单词

自然地理学英语单词

2022-11-20 2页

课题Unit6Colours2

课题Unit6Colours2

2022-10-08 5页

教师管理工作总结

教师管理工作总结

2023-10-15 5页

磷矿项目投资运营分析报告范文模板(投资分析评价).docx

磷矿项目投资运营分析报告范文模板(投资分析评价).docx

2022-07-26 24页

完整版宏观经济学名词解释

完整版宏观经济学名词解释

2023-10-05 12页

干部考察 表态发言稿

干部考察 表态发言稿

2023-10-23 8页