办理外侨综合所得税结算申报流程

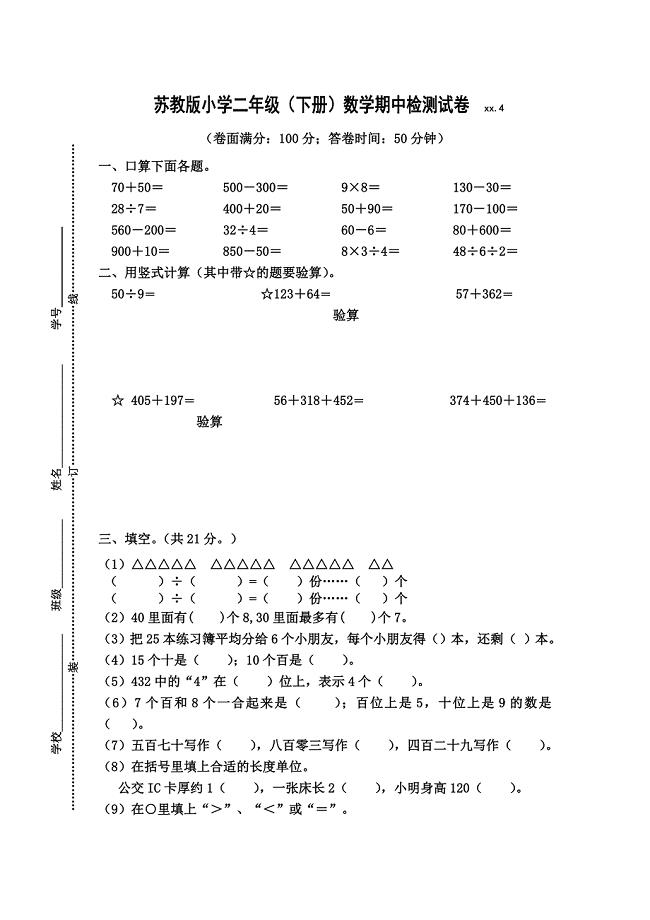

19页1、编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第1页 共1页外僑綜合所得稅申報實務講習會主講人:黃莉惠97年度本文件僅供講習使用,如有疑問請洽北區國稅局新竹市分局 (03)5336060 分機 409一、辦理外僑綜合所得稅結算申報流程Alien Individual Income Tax Filing Flow Chart備妥護照(正本及影本)、居留證(正本及影本)、扣繳憑單正本、國外所得證明及相關免稅額、扣除額之文件。Prepare passport ,ARC, withholding tax statement,overseas income proof and other relevant tax exemption and tax deduction documents.填寫外僑綜合所得稅結算申報書Fill in Individual Income Tax Return.自繳稅款?Self-paying tax至代收稅款處繳納稅款Pay tax at Receiving Tax Counter是Yes 否 No 至居留證地址所在地之國稅局第二課(股)辦理申報

2、Declare Individual Income Tax Return.二、外僑綜合所得稅與居留期間的關係 凡有中華民國來源所得之外僑,應就其中華民國來源所得,依法繳納綜合所得稅。外僑因在華居留期間不同,分為非中華民國境內居住之個人(非居住者)與中華民國境內居住之個人(居住者)。其納稅方式亦有不同,茲說明如下: ( 1 )非居住者:外僑於同一課稅年度內,在台居留合計未滿183天者。a ) 同一課稅年度(1月1日至12月31日)內,在華居留不超過90天者,其中華民國來源之扣繳所得,由扣繳義務人依規定扣繳率 就源扣繳,無庸申報;其中華民國來源之非屬扣繳範圍之所得,應於離境前辦理申報納稅。b )同一課稅年度內,在華居留合計超過90天未滿183天者,其中華民國來源之扣繳所得,由扣繳義務人 就源扣繳,其非屬扣繳範圍之所得(包括因在中華民國境內提供勞務而自境外雇主取得之勞務報酬),自行依規定扣繳率 申報納稅。( 2 )居住者:外僑於同一課稅年度內,在台居留合計滿183天以上者。應將該年度在中華民國境內取得之各類所得,及因在中華民國境內提供勞務而自境外雇主取得之勞務報酬等總計,減除免稅額及扣除額後

3、之綜合所得淨額,依累進稅率 結算申報 綜合所得稅。其應納稅額計算方式如下:綜合所得總額 - 免稅額 - 扣除額 = 綜合所得淨額 綜合所得淨額 * 稅率 - 累進差額 = 應納稅額Alien individual income tax and the period of residenceFor any alien having income from sources in the Republic of China, individual income tax shall be levied on the income derived from such sources in accordance with the Income Tax Act of the ROC. Alien taxpayers are divided into Non-Residents of the ROC and Residents of the ROC based on their length of stay. The following are the different ways for alien

4、s to file income tax returns()Non-Residents of the Republic of China a ) For an individual who stays in the Republic of China not more than 90 days within a taxable year (January 1st to December 31st), the income derived from sources in the Republic of China shall be withheld according to the withholding rate and paid at the respective sources. The taxpayer need not file an income tax return. b )For an individual who stays in the Republic of China over 90 days but less than 183 days within the s

《办理外侨综合所得税结算申报流程》由会员壹****1分享,可在线阅读,更多相关《办理外侨综合所得税结算申报流程》请在金锄头文库上搜索。

小学二年级(下册)数学期中检测试卷

县地方税务局征管软件信息采集录入工作情况汇报工作汇报

长沙功能性薄膜材料技术研发项目投资计划书

4273995928学习劳模精神心得体会

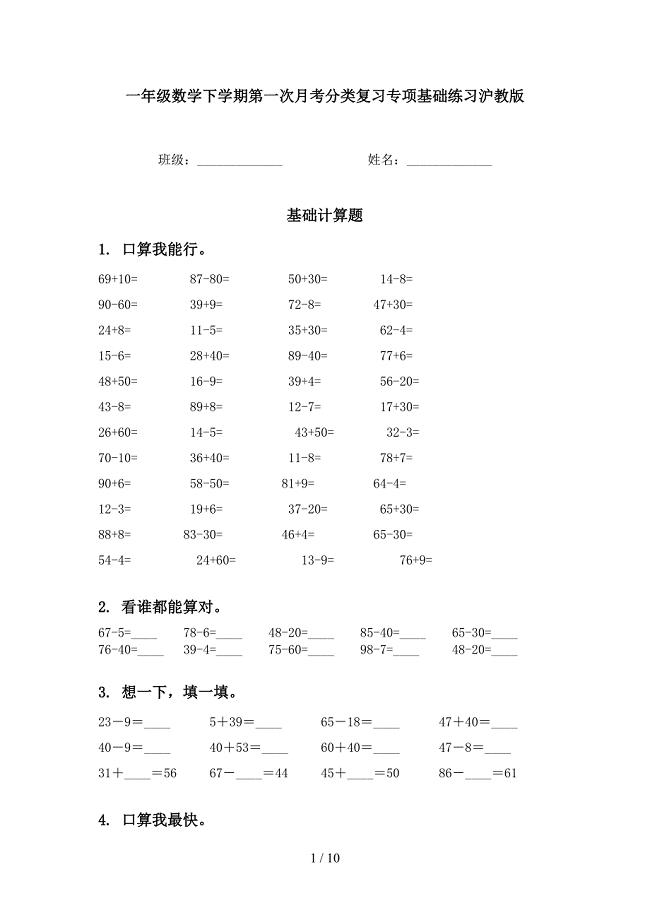

一年级数学下学期第一次月考分类复习专项基础练习沪教版

2011十大高质量汽车【福布斯中文网】

2600头种猪养殖扩建项目可行性研究报告-资金申请报告

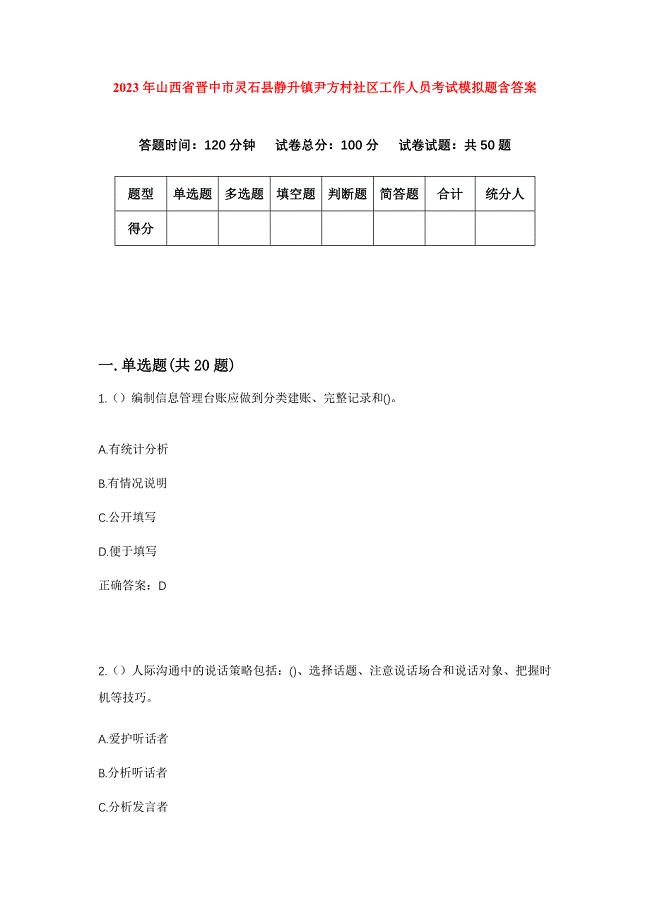

2023年山西省晋中市灵石县静升镇尹方村社区工作人员考试模拟题含答案

车辆安全隐患排查报告

电商运营实施方案计划书

劳动最光荣励志演讲稿

广州白葡萄酒营销策划方案1

五年级数学教研工作总结范文.doc

五矿有色访谈纪要-张寿连总经理

中学语文阅读教学的困境及对策

树脂结合剂磨具制造

以白云石和菱镁石为原料的真空铝热还原炼镁实验研究毕业论文

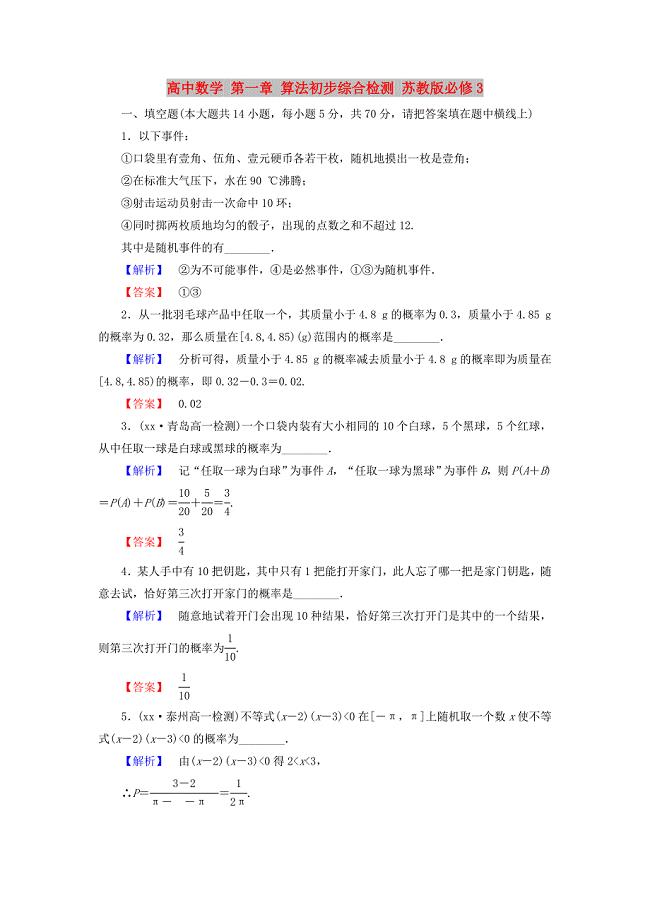

高中数学 第一章 算法初步综合检测 苏教版必修3

2022感恩工作演讲稿合集七篇

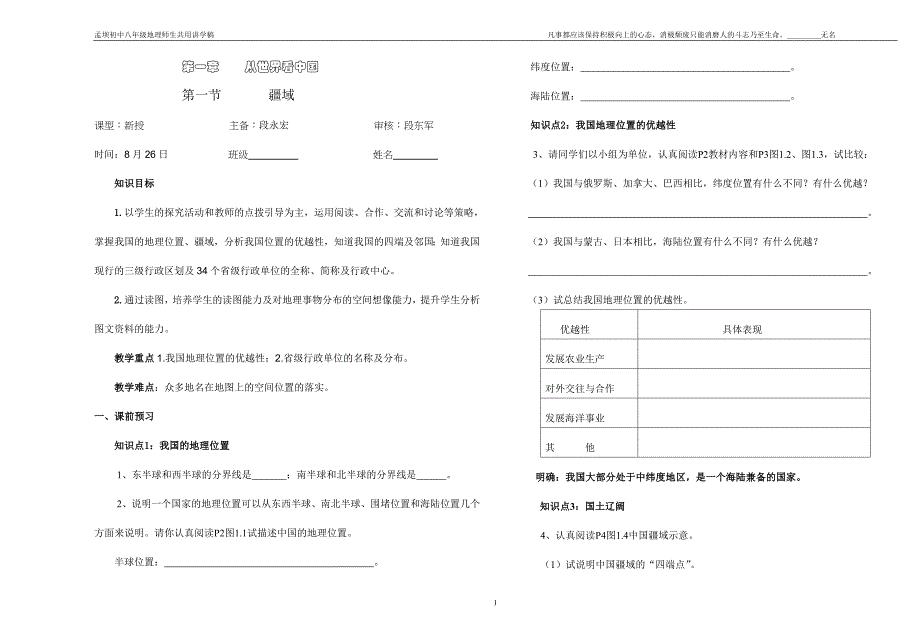

第一章第一节疆域

法制宣传日宣传活动总结

法制宣传日宣传活动总结

2023-09-25 3页

2021年党建带团建工作总结

2021年党建带团建工作总结

2023-07-07 4页

公司财务个人工作总结标准范本(2篇).doc

公司财务个人工作总结标准范本(2篇).doc

2023-11-01 4页

幼儿园教研活动总结范文

幼儿园教研活动总结范文

2023-04-13 23页

学校法制教育活动工作总结(3篇).doc

学校法制教育活动工作总结(3篇).doc

2023-02-15 7页

端午节银行活动总结(2篇).doc

端午节银行活动总结(2篇).doc

2023-04-06 2页

学生会秘书处个人总结(6篇)

学生会秘书处个人总结(6篇)

2022-12-09 13页

人力资源助理年终个人总结(2篇)

人力资源助理年终个人总结(2篇)

2024-02-10 4页

2021年安装公司工作总结.doc

2021年安装公司工作总结.doc

2022-08-11 2页

可行性研究报告范文

可行性研究报告范文

2023-02-21 5页