瑞幸咖啡研究报告

20页1、Anita Yiu +852-2978-7200 | Goldman Sachs (Asia) L.L.C.Sho Kawano +81(3)6437-9905 | Goldman Sachs Japan Co., Ltd.Timothy Zhao +65-6654-5771 | Goldman Sachs (Singapore) PteSoYoung Lee +852-2978-7098 | Goldman Sachs (Singapore) Pteconsumer in the form of delivery and targeted locationsstand to benefit, in our view.3) Millennials on cooking: No thanks, not yet - 35% of respondents in a Tencent survey were willing to rent a home without a kitchen. When eating out, experience is now the top ranked

2、 factor for restaurant choice, surprisingly above food safety, which is probably why Luckin complements its delivery stations with full-service stores.Key stocks Elevator advertising giant: Focus Media (Buy)nConveniently located snack stores: Zhou Hei Ya (Buy)nClear delivery strength: Yum China (Neutral)nFood delivery (Ele.me): Alibaba (Buy, on CL)nWhat else surprised us this monthTravel to Korea +13% yoy in March, the first positiven print since the group tour ban in 2017 . We expect continued

3、rebound ahead. We also expect outbound travel to HK to remain healthy at +MSD in 2018E.China Consumer Pulse Check: From 0 to 5mn: What the explosive growth of one coffee brand reveals about Chinese consumers 16 May 2018 | 4:59PM HKT3 trends relevant for advertising, retailing and food services In just 7 months, Luckin Coffee (Privately held) has catapulted from nonexistence to selling 5mn cups of coffee in the 4-month trial operation period ending May 8. We do not take a view on the longer term

4、success of its business model, but we think the brands surging popularity highlights three trends that are relevant for our covered companies:1) Getting attention: Real world presence (still) critical - Theres no doubt that digital marketing is important, but webelieve it would be a mistake for companies to ignore offline presence. In particular, Luckin highlighted that elevator advertising (industry +c.20% yoy in 2017) has helped it rapidly build brand awareness. We also expect more development

《瑞幸咖啡研究报告》由会员欧**分享,可在线阅读,更多相关《瑞幸咖啡研究报告》请在金锄头文库上搜索。

美的企业文化手册 -2024-

销售结束后“售楼部”如何进行财税处理? -房地产-2024

广电总局《视音频内容分发数字版权管理标准体系》 -2024-

土增清算普通住宅与非普通住宅可以合并计算增值额? -房地产-2024

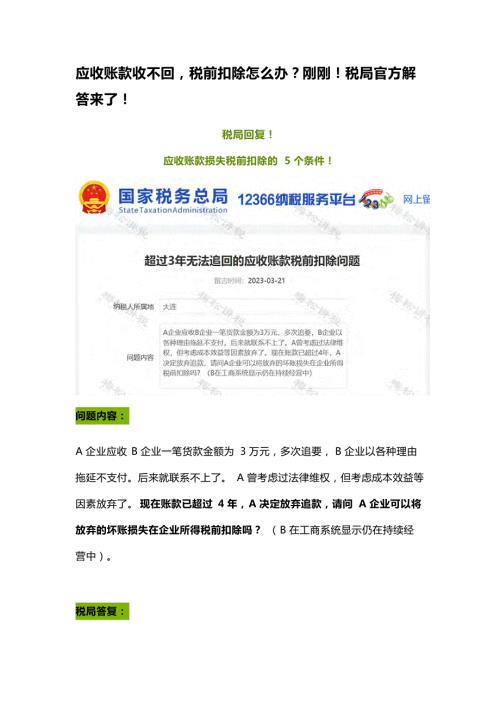

应收账款收不回税前扣除怎么办?刚刚!税局官方解答来了! -房地产-2024

土地增值税清算的成本分摊方法及面积数据来源 -房地产-2024

春季系列(打包春天主题)活动策划方案 -房地产-

2023某山居项目2月推广策略 -房地产-

2周年庆3-4月春季美陈活动策划案 -房地产-2023

广州市2023年重点建设预备项目计划 -房地产-2023

【统计】2002年-2022年全国房地产销售面积数据 -房地产-

【统计】2002年-2022年全国房地产销售金额数据 -房地产-

广州市2023年重点建设项目计划 -房地产-2023

2022年11月重庆房地产市场研究报告 -房地产月报-

12月月度暖场(暖冬计划 全城升温主题)活动策划方案 - 房地产-2022

12月系列暖场(冬日美好生活节主题)活动策划方案 - 房地产-2022

2022企业元宇宙年会(破壁·潮玩无界主题)活动策划方案-

2022企业集团颁奖新春年会(新跨越 新起航主题)活动策划方案-

逸东诺富特酒店开业盛典活动策划方案 -房地产-2022 _解密

12月“岁末狂欢趴 圆梦畅想曲”系列暖场活动策划方案 -房地产-2022

(终)沈阳铁路局-既有铁路土地和地上附着物资产综合开发5.0

(终)沈阳铁路局-既有铁路土地和地上附着物资产综合开发5.0

2024-05-05 122页

出租屋管理规程 - 副本

出租屋管理规程 - 副本

2024-03-21 3页

湘科版小学科学五年级上册教学计划

湘科版小学科学五年级上册教学计划

2024-01-28 6页

道路旅客运输(旅游客运)企业安全风险辨识分级管控清单

道路旅客运输(旅游客运)企业安全风险辨识分级管控清单

2024-01-09 15页

特种作业人员安全教育培训记录(包含各个工种)

特种作业人员安全教育培训记录(包含各个工种)

2024-01-09 12页

建筑企业安全风险清单和隐患排查依据清单大全(附依据)

建筑企业安全风险清单和隐患排查依据清单大全(附依据)

2024-01-09 24页

《PhotoShop3图像处理》教学大纲

《PhotoShop3图像处理》教学大纲

2024-01-09 12页

高校教师绩效考核激励机制优化研讨发言

高校教师绩效考核激励机制优化研讨发言

2024-01-09 7页

公司安全生产考核与奖惩办法附各级考核与奖惩评定表

公司安全生产考核与奖惩办法附各级考核与奖惩评定表

2024-01-09 17页

湘教版六年级科学上册考试复习知识点汇总

湘教版六年级科学上册考试复习知识点汇总

2024-01-09 11页