内部会计控制相关的外文翻译

15页1、Disclosure on Internal Control SystemsAs a Substitute of Alternative Governance MechanismsSergio BerettaAccounting DepartmentBoccioni UniversityAccording to agency theory, various governance mechanisms reduce the agency problem between investors and management (Jensen and Heckling, 1976; Gillan, 2006). Traditionally, governance mechanisms have been identified as internal or external. Internal mechanisms include the board of directors, its role, structure and composition (Fama, 1980; Fama and Jen

2、sen, 1983), managerial share ownership (Jensen and Meckling, 1976) and incentives, the supervisory role played by large shareholders (Demsetz and Lehn, 1985), the internal control system (Bushman and Smith, 2001), bylaw and charter provisions (anti-takeover measures) and the use of debt financing (Jensen, 1993). External control is exerted by the market for corporate control (Grossman and Hart, 1980), the managerial labor market (Fama, 1980) and the product market (Hart, 1983).After the various

3、financial scandals that have shaken investors worldwide, corporate governance best practices have stressedin particular the key role played by the internal control system (ICS) in the governance of the firm. Internal control systems contribute to the protection of investors interests both by promoting and giving assurance on the reliability of financial reporting, and by addressing the boards attention on the timely identification, evaluation and management of risks that may compromise the attai

4、nment of corporate goals. These functions have been widely recognized by the most diffused frameworks for the design of ICS that have stated the centrality of internal control systems in providing reasonable assurance toinvestors regarding the achievement of objectives concerning the effectiveness and efficiency of operations, the reliability of financial reporting and the compliance with laws and regulations (COSO, 1992; 2004).Notwithstanding their relevance, investors cannot directly observe I

《内部会计控制相关的外文翻译》由会员鲁**分享,可在线阅读,更多相关《内部会计控制相关的外文翻译》请在金锄头文库上搜索。

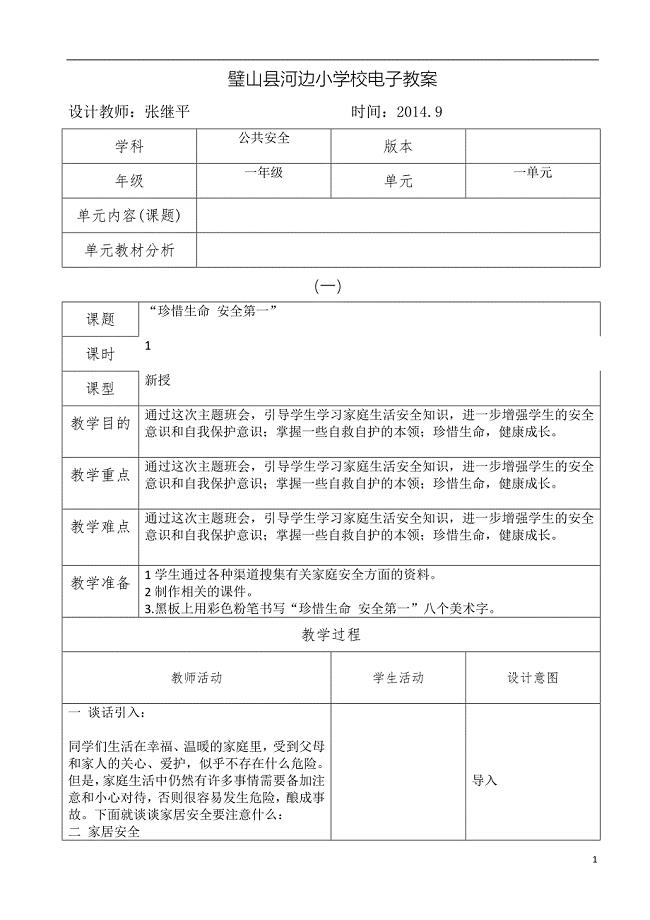

20140831160043公共安全

课内阅读训练

区域销售代理合同样本通用版

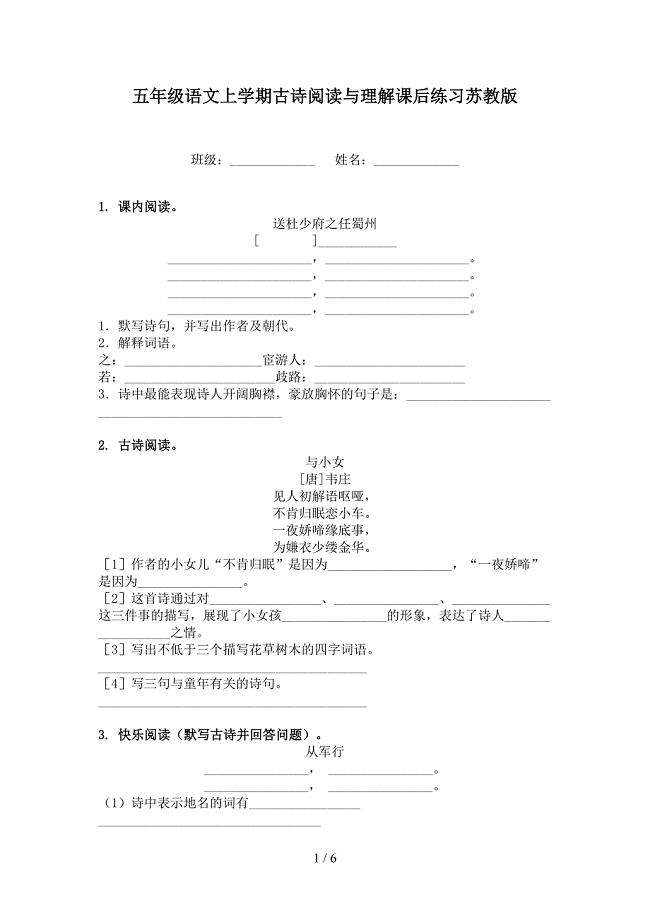

五年级语文上学期古诗阅读与理解课后练习苏教版

放飞幻想演讲稿3篇

深圳牛津版九年级下课文带翻译

fff20051210160401_456688365

福师2017秋季《教育统计与测量评价》在线作业二-答案

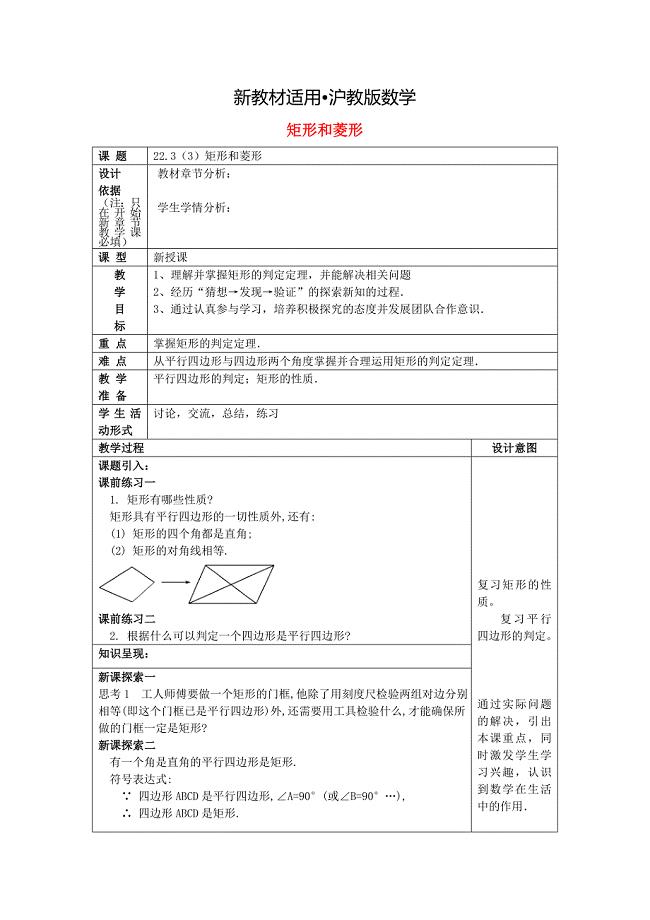

【最新教材】八年级数学下册22.3特殊的平行四边形3矩形和菱形教案沪教版五四制

在2022年教师节表彰大会上的领导讲话

班主任如何开好家长会

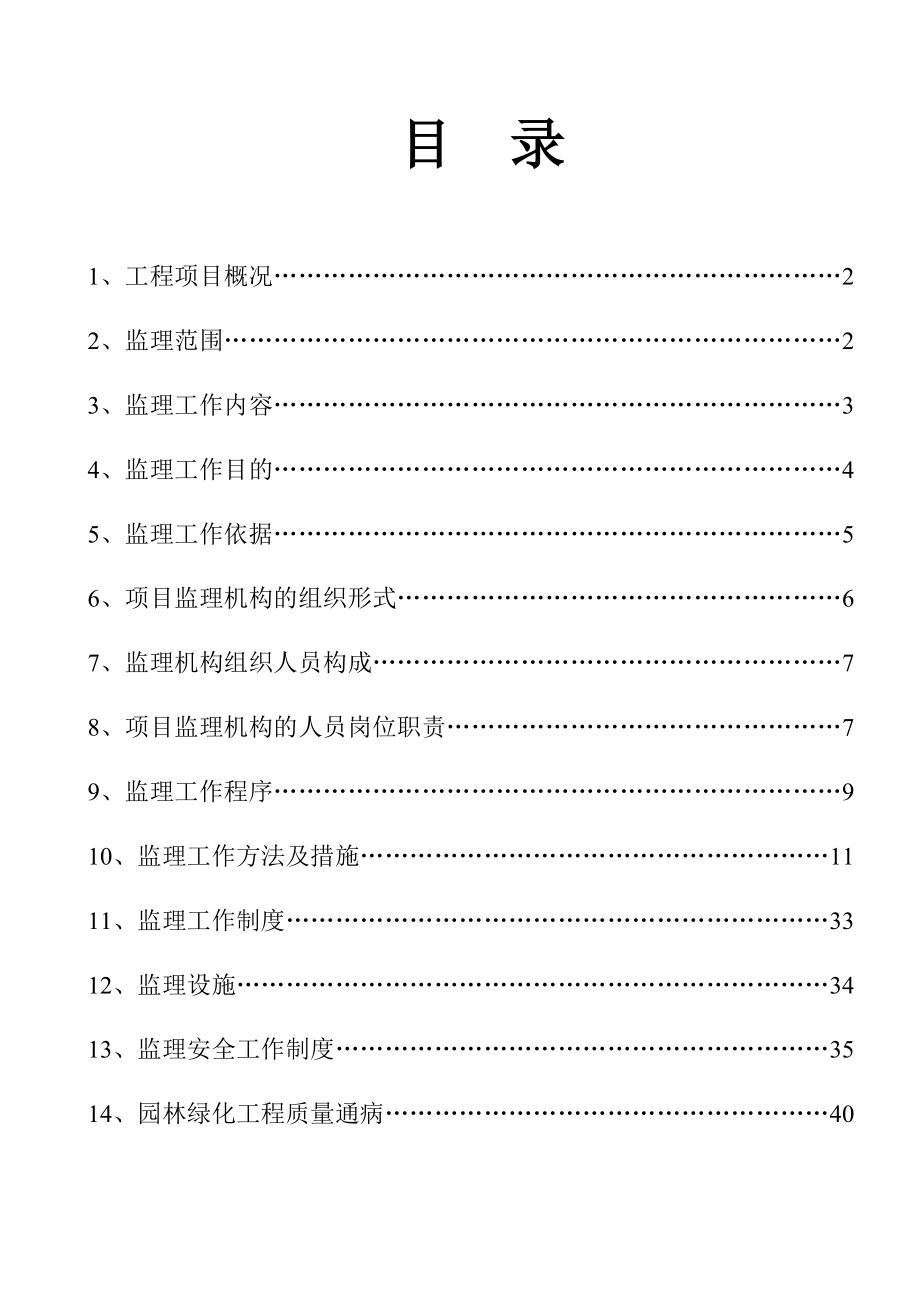

金阳绿化工程监理规划

幼儿园小班社会活动:小手流血了

房管处职工队伍建设半年工作总结

初中英语1600个词组单词带中文打印版

幼儿园中班教案《小黄和小蓝》含反思(通用)

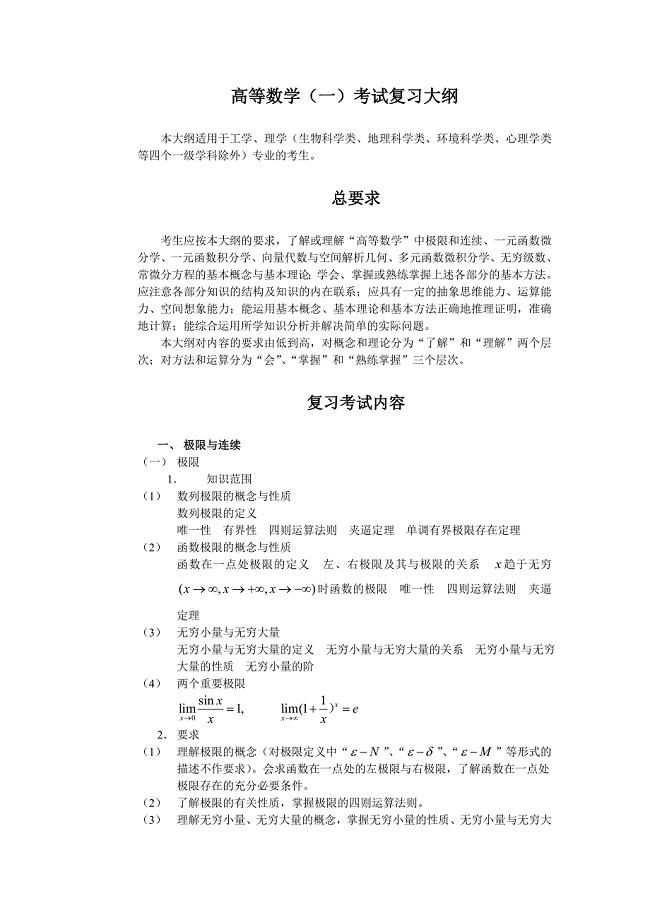

高等数学一考复试习大纲

注册测绘师考试《测绘管理与法律法规》考试模拟

电影幸福终点站的观后感

企业员工年度健身计划书

销售回款技巧

销售回款技巧

2022-11-18 7页

分解质因数练习题10道

分解质因数练习题10道

2023-03-16 7页

模板支撑体系各规范及标准汇总

模板支撑体系各规范及标准汇总

2023-10-09 8页

调幅信号发生器设计

调幅信号发生器设计

2023-01-14 21页

宪法在我心中班会教案《宪法在我心中》班会教案

宪法在我心中班会教案《宪法在我心中》班会教案

2022-08-27 16页

上班族如何避免电脑辐射

上班族如何避免电脑辐射

2023-09-14 3页

涉外仲裁裁决的撤销问题及其完善

涉外仲裁裁决的撤销问题及其完善

2024-01-26 10页

高中语文《我的呼吁》说课稿

高中语文《我的呼吁》说课稿

2023-02-21 3页

白塔区第三小学校2018二年级下学期数学3月月考试卷

白塔区第三小学校2018二年级下学期数学3月月考试卷

2023-05-07 13页

曼陀罗药用与毒性原理

曼陀罗药用与毒性原理

2024-01-29 6页