高盛香港房地产市场租金增长紧跟零售业快速复苏步伐

21页1、Fast retail sales pace growth to continue Our Hong Kong retail team has revised up its estimates for 2018E inbound visitor and retail sales growth to 7% and 8% yoy, vs 3% and 2% in 2017, on the back of favorable currency trends, resilient China consumption sentiment, and companies improved controls over store expansion and product mix enhancement. Our retail team sees near-term data points remaining solid into the June 2018 quarter, including airline booking data, FX trends, and various consumer

2、 companies comments on latest trends.Broad-based recovery in both tourist and domestic spending Growth in both overnight (+13%) and same-day (+14%) Chinese arrivals has propelled a faster uptick in tourist spending YTD, and in addition, we also highlight a pick-up in growth on the domestic consumption front. Breaking down the c.10% yoy growth in Hong Kong retail sales in the three-month period to Feb 2018, we note that c.7 pp was from tourist spending, and c.3pp from domestic consumption (vs lar

3、gely flattish growth for the preceding year), which together have more than offset a negative c.5pp one-off swing (mostly motor vehicle sales).Prime shopping mall rents set to rise: Initiate Wharf REIC at Buy, upgrade Hysan to Neutral CBRE estimates a 0.3% qoq increase for high street shop rents in Hong Kong in 1Q18, marking the first increase in the past five years. We believe that a faster and broader retail sales recovery, coupled with stabilizing high street shop rents, will set the stage fo

4、r prime shopping malls rents to resume growth. We now model 7% retail spot rent growth p.a. in 2018E/19E.We are turning more positive on landlords with retail exposure. We initiate Wharf REIC at Buy for its direct access to quality retail properties with higher-than-peer exposure to tourism spending, track record in delivering better-than-market tenant sales growth, and already improved OCR situation as of end-2017. We also upgrade Hysan Development from Sell to Neutral on the back of a better p

《高盛香港房地产市场租金增长紧跟零售业快速复苏步伐》由会员欧**分享,可在线阅读,更多相关《高盛香港房地产市场租金增长紧跟零售业快速复苏步伐》请在金锄头文库上搜索。

钟薛高营销策划方案 -2024-

2024Q1猎聘季度招聘调研报告 -

美的企业文化手册 -2024-

销售结束后“售楼部”如何进行财税处理? -房地产-2024

广电总局《视音频内容分发数字版权管理标准体系》 -2024-

土增清算普通住宅与非普通住宅可以合并计算增值额? -房地产-2024

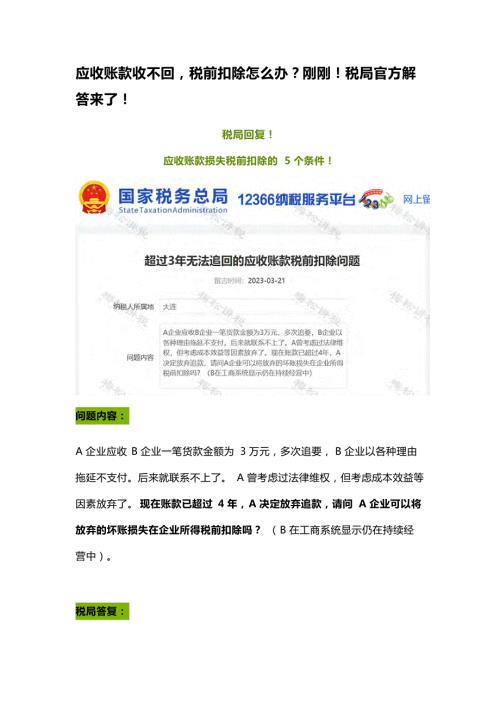

应收账款收不回税前扣除怎么办?刚刚!税局官方解答来了! -房地产-2024

土地增值税清算的成本分摊方法及面积数据来源 -房地产-2024

春季系列(打包春天主题)活动策划方案 -房地产-

2023某山居项目2月推广策略 -房地产-

2周年庆3-4月春季美陈活动策划案 -房地产-2023

广州市2023年重点建设预备项目计划 -房地产-2023

【统计】2002年-2022年全国房地产销售面积数据 -房地产-

【统计】2002年-2022年全国房地产销售金额数据 -房地产-

广州市2023年重点建设项目计划 -房地产-2023

2022年11月重庆房地产市场研究报告 -房地产月报-

12月月度暖场(暖冬计划 全城升温主题)活动策划方案 - 房地产-2022

12月系列暖场(冬日美好生活节主题)活动策划方案 - 房地产-2022

2022企业元宇宙年会(破壁·潮玩无界主题)活动策划方案-

2022企业集团颁奖新春年会(新跨越 新起航主题)活动策划方案-

市政工程质量奖罚条例

市政工程质量奖罚条例

2023-04-27 14页

《现代物流学》习题.doc

《现代物流学》习题.doc

2022-11-02 38页

民政办2019年上半年工作总结及下半年工作计划.doc

民政办2019年上半年工作总结及下半年工作计划.doc

2022-09-02 3页

贵州省辐射安全和防护状况年度评估报告表.doc

贵州省辐射安全和防护状况年度评估报告表.doc

2023-08-16 14页

浅谈保险公司内部控制工作在公司合规风险管理机制中的重要性 V.2.doc

浅谈保险公司内部控制工作在公司合规风险管理机制中的重要性 V.2.doc

2023-02-02 3页

数据库课程设计高校教材管理系统

数据库课程设计高校教材管理系统

2023-10-09 18页

中建_浙江杭州万新大厦项目工程成本分析研究报告_21页.doc

中建_浙江杭州万新大厦项目工程成本分析研究报告_21页.doc

2022-09-05 22页

眉山万景国际项目市场调研报告-69doc-2007年.doc

眉山万景国际项目市场调研报告-69doc-2007年.doc

2023-11-22 69页

2011年河南省许昌市长葛市房地产市场调研报告_24页.doc

2011年河南省许昌市长葛市房地产市场调研报告_24页.doc

2022-11-26 24页

顾客投诉处理程序.doc

顾客投诉处理程序.doc

2022-11-10 7页