财务管理最佳实践之现金管理

10页1、Cash Mgmt updateBest Practice Financial Processes: Cash Management2PwC175gCash Management - Best Practice ObjectivesCash Management ObjectivesOrganisationPeopleProcessesControlsMeasuresInformation SystemsManage short term liquidity and long term funding requirementsMinimise companys cost of capitalEfficiently manage the processing of cash transactions Effectively forecast cash requirementsManage petty cash efficientlyCentralised cash office & poolingIntegrated with Accounts functionsRecord/manag

2、e receipts and paymentsManage cash positionPerform reconciliationsPerform period end closing & reportingPolicies & ProceduresBank liaisonAuthorisation limitsInternal controlsSpeed of reportingAccuracy of forecastingReturn on CapitalIntegrated bank account with sub- ledgersAutomatic bank reconciliationsOn-line/real timeCash forecastingCash management skillsLiaison with financial institutions3PwC175gProcess FeaturesSegregate cash management from accounts receivable and accounts payable functionsLo

3、calise cash collectionMinimise level of petty cash requirementsTransmit mechanisms evaluated on cost and risk basisCreate netting arrangement with internal business partnersObtain pan-European banking facilities that allow netting off of account balancesMap cash collection and payment cycles, identify actions to minimise these periodsMinimum number of banking relationships maintained to ensure coverage and purchasing powerClear unmatched cash within 1 dayRegular reconciliation of all cash books.

4、 Maintain petty cash imprest systemsObtain access to on line bank statementsMonitor the cost of cash transmission mechanismsCash balances reported on a daily basis by account and business centresTreasury determine short term cash requirements from cash forecast and daily reportCash surpluses managed by TreasuryPetty cash/foreign currency floats periodically auditedCompany loan accounts reconciled monthlyTreasury consolidate and manage cash forecast requirementsMonitor bank facilities to minimise

《财务管理最佳实践之现金管理》由会员油条分享,可在线阅读,更多相关《财务管理最佳实践之现金管理》请在金锄头文库上搜索。

最新学校新冠肺炎疫情突发事件应急处置办法和流程

最新疫情防控期间学校用餐与食堂管理规定和师生一日流程图

最新Xx省xx区返学师生员工健康登记表

诊所简介

高中英语-第二单元-《the-United-Kingdom》课件-新必修5

新版新目标英语七年级下unit4--Don't-eat-in-class课件

新版PEP六年级英语unit6-how-do-you-feel-A-Let's-talk

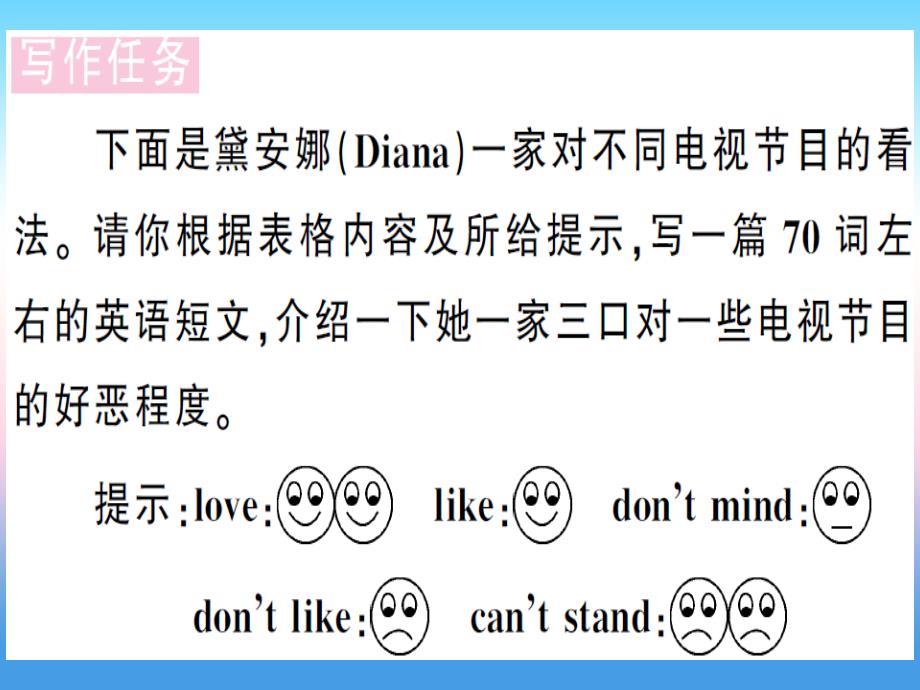

安徽专版2018秋八年级英语上册Unit5Doyouwanttowatchagameshow第6课时习题课件新人教目标版

酸的和甜的教学课件.doc

Lesson-1-Where-do-we-go-from-here概要

Docker技术与实践

七年级英语下册-Unit-9-What-does-he-look-like(第3课时)(Grammar-Focus-3d)同步语法精讲精练课件-(新版

《I'm-going-to-do-the-high-jump》PPT课件3

高二英语外研版-必修5-Module-2-A-Job-Worth-Doing-Reading课件

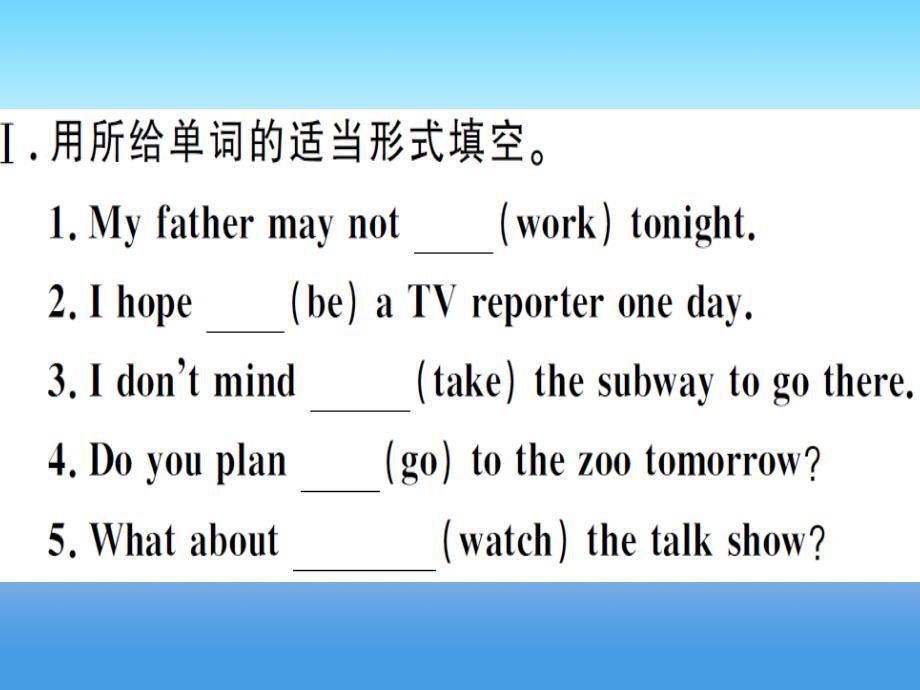

英语片段教学-I-can-do-it

Adobe公司简介

安徽专版2018秋八年级英语上册Unit5Doyouwanttowatchagameshow第2课时习题课件新人教目标版

第二单元全课件Unit2-What-time-do-you-go-to-school-全课件

第18课-Windows的磁盘管理与安全

第12章--Windows-Server-2008路由及远程访问

企业节后复工复产隐患排查

企业节后复工复产隐患排查

2024-05-02 56页

机械作业安全知识

机械作业安全知识

2024-05-02 61页

apqp 第3版 & 控制计划 第1版

apqp 第3版 & 控制计划 第1版

2024-04-08 20页

消防器材及巡查要点

消防器材及巡查要点

2024-04-06 36页

推动未来产业创新发展PPT课件

推动未来产业创新发展PPT课件

2024-02-09 36页

职业病危害专项治理

职业病危害专项治理

2024-01-31 31页

实现社会主义现代化和中华民族伟大复兴

实现社会主义现代化和中华民族伟大复兴

2024-01-28 18页

小学高年级读本教学建议

小学高年级读本教学建议

2024-01-28 31页

小学高年级读本编写思路和主要内容介绍

小学高年级读本编写思路和主要内容介绍

2024-01-28 24页

筑牢坚不可摧的钢铁长城

筑牢坚不可摧的钢铁长城

2024-01-28 27页