I-Asgn10_从业资格考试_资格考试认证_教育专区

11页1、LESSON 10 AssignmentQuestion 1 (60 marks)Computer questionIn early 2007, Jane Lender, an officer of the Commerce Bank, was evaluating the account of Johnson Lumber Co., which uses a line of credit to manage its seasonal requirements. This year the company needed more than its usual credit limit and, unlike previous years, the account was not paid off. Jane has been asked by her manager to study the account and prepare a report.Jane studied the file and found that the company was managed by profe

2、ssional managers with backgrounds in marketing and production. She also identified that the firms profits had been growing steadily, though not spectacularly considering the inflation rate. Jane is aware that her manager will require financial analysis to back up her report. Also, considering the executive attention span, she decided to keep her report brief. The Income Statement and Balance Sheet of Johnson Lumber Co. is given below.JOHNSON LUMBER COIncome Statementfor years ended October 31, 2

3、0042006(thousands of dollars)200420052006Net sales9,00010,50013,500Cost of goods soldMaterial and labour7,7259,00011,625Overhead180255285Earnings before interest and tax1,0951,2451,590Interest expenses454590Earnings after taxes1,0501,2001,500Taxes at 50%525600750Earnings after tax525600750Dividends390450450Retained earnings135150300The net sales is arrived after a quantity discount of 90, 105, and 160 respectively in 2004, 2005, and 2006. Overhead includes the following depreciation.Plant1201351

4、65Equipment526075JOHNSON LUMBER COBalance Sheetas at October 31, 2004-2006200420052006ASSETSCash271241121Marketable securities315150Accounts receivable1,4101,5151,785Inventories1,5151,7251,965Total current assets3,5113,4963,871Loans to dealers150150225Plant (net of depreciation)1,6501,8002,700Equipment (net of depreciation)1,3501,4251,515Total fixed assets3,1503,3754,440Total assets6,6616,8718,311LIABILITIES AND EQUITYAccounts payable1,3051,5151,680Notes payables15000Bank loan00975Total current

《I-Asgn10_从业资格考试_资格考试认证_教育专区》由会员鲁**分享,可在线阅读,更多相关《I-Asgn10_从业资格考试_资格考试认证_教育专区》请在金锄头文库上搜索。

施工现场安全管理资料的整理总则.doc

李煜《虞美人》教学设计.doc

青年科技拔尖人才项目申报书

国庆节活动方案.doc

通风机安装工程施工组织设计(方案)

瑞国江畔花园验收监测报告表--大学毕设论文.doc

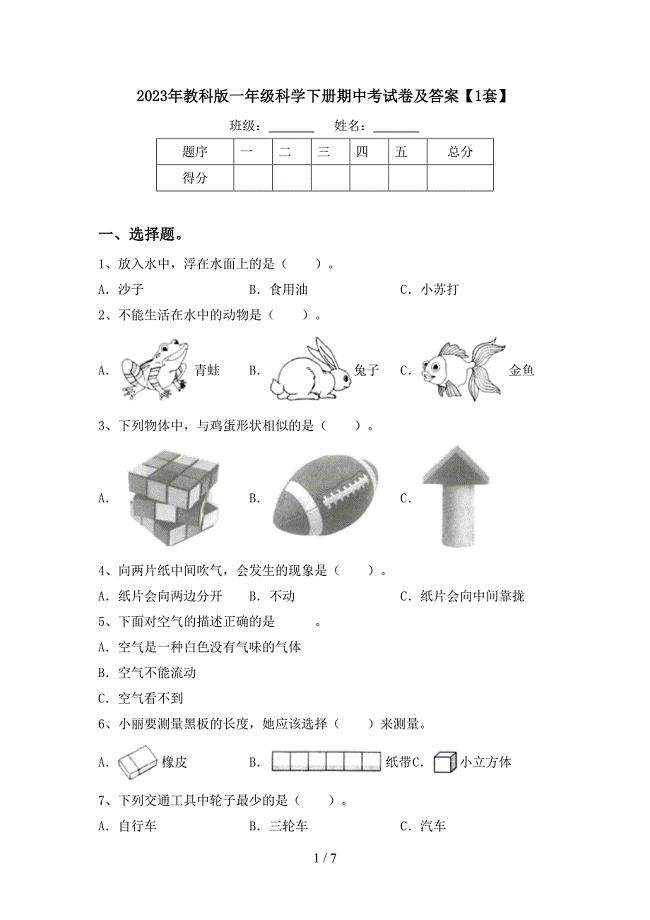

2023年教科版一年级科学下册期中考试卷及答案【1套】.doc

人教版二年级上册第18课《称赞》教案及反思

GCT词汇每日练习题(046).docx

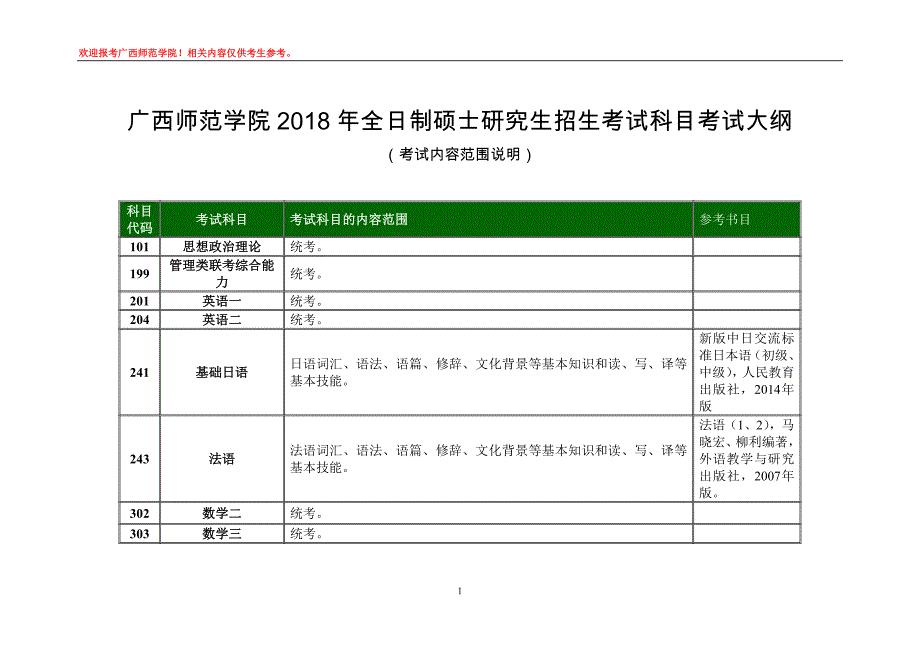

广西师范学院2018年全日制硕士研究生招生考试科目考试大纲.doc

党校入学考试二.doc

最新CSFB配置方案.doc

资料——防火墙发展.doc

2023感恩的演讲稿708范文.docx

中国互联网络调查报告(2006)(天选打工人).docx

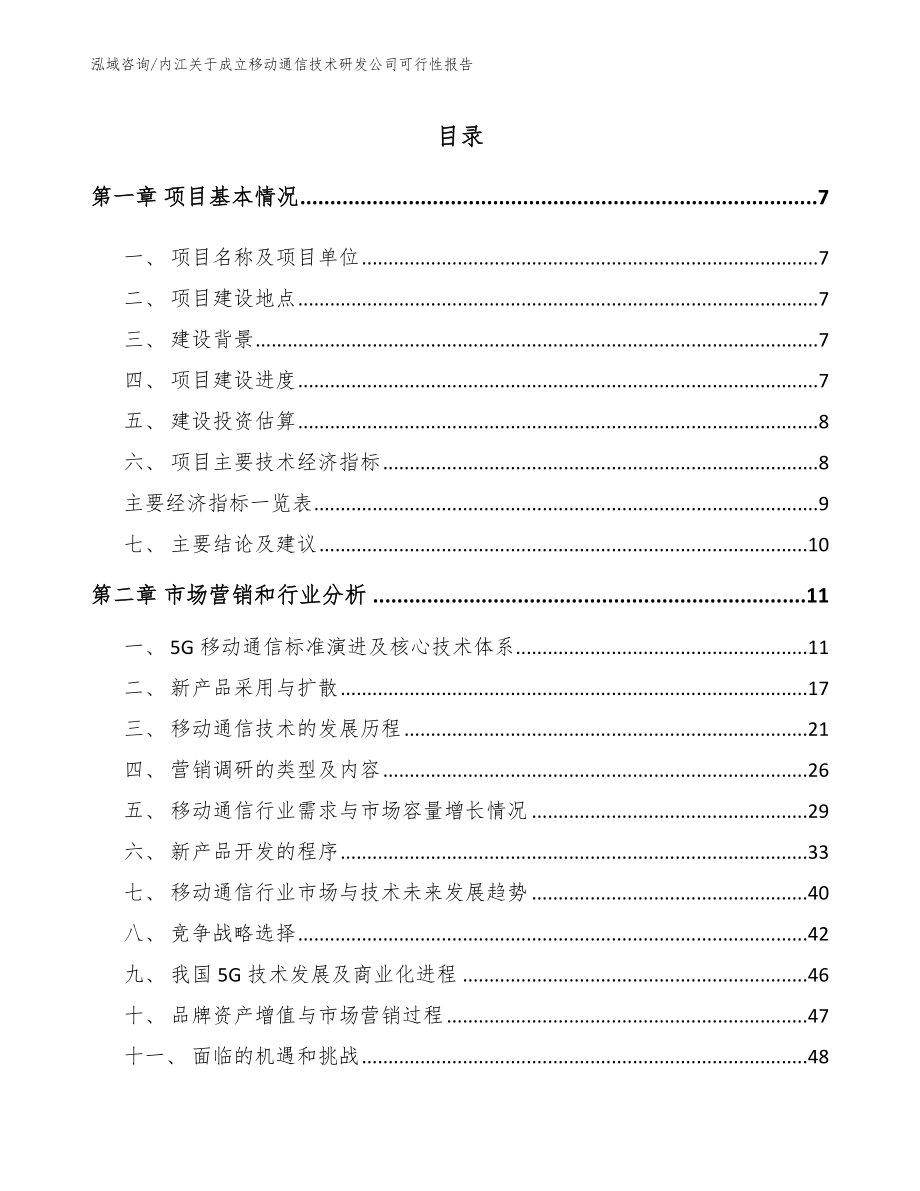

内江关于成立移动通信技术研发公司可行性报告【范文模板】

消防安全应急演练总结.docx

13服12014秋期服装设计半期考试试卷(陈晓梅).doc

道路工程施工组织设计通用范本模板.doc

大学生实习报告:2022大学生文员实习报告.docx

浙江嘉兴市公安局南湖区分局招考聘用警务辅助人员124人笔试题库含答案解析

浙江嘉兴市公安局南湖区分局招考聘用警务辅助人员124人笔试题库含答案解析

2023-11-07 70页

公务员工作总结怎么写-通用版.docx

公务员工作总结怎么写-通用版.docx

2023-04-12 4页

2023年山东省济南市章丘区黄河街道西李村社区工作人员考试模拟试题及答案

2023年山东省济南市章丘区黄河街道西李村社区工作人员考试模拟试题及答案

2023-05-07 81页

2022年公共营养师-公共营养师(三级)考试题库模拟1

2022年公共营养师-公共营养师(三级)考试题库模拟1

2022-12-30 14页

2021年苏教版六年级数学下册三单元考试卷及参考答案精品.doc

2021年苏教版六年级数学下册三单元考试卷及参考答案精品.doc

2023-02-16 6页

2023年自考专业(会计)《基础会计学》考试全真模拟易错、难点汇编第五期(含答案)试卷号:3

2023年自考专业(会计)《基础会计学》考试全真模拟易错、难点汇编第五期(含答案)试卷号:3

2022-08-12 15页

化工原理试题及其答案

化工原理试题及其答案

2024-02-16 27页

2022年造价工程师-建设工程技术与计量(安装工程部分)考试题库_2

2022年造价工程师-建设工程技术与计量(安装工程部分)考试题库_2

2023-05-27 9页

冀教版一年级科学上册期中测试卷(及答案).doc

冀教版一年级科学上册期中测试卷(及答案).doc

2022-09-17 5页

2023年广西来宾市劳动人事争议仲裁院招考聘用笔试题库含答案解析

2023年广西来宾市劳动人事争议仲裁院招考聘用笔试题库含答案解析

2023-06-02 64页