股权结构与公司业绩[外文翻译]

8页1、外文翻译Ownership Structure and Firm Performance: Evidence from Israel Material Source: Journal of Management and Governance Author: Beni Lauterbach and Alexander Vaninsky 1.IntroductionFor many years and in many economies, most of the business activity was conducted by proprietorships, partnerships or closed corporations. In these forms of business organization, a small and closely related group of individuals belonging to the same family or cooperating in business for lengthy periods runs the firm

2、 and shares its profits.However, over the recent century, a new form of business organization flourished as non-concentrated-ownership corporations emerged. The modern diverse ownership corporation has broken the link between the ownership and active management of the firm. Modern corporations are run by professional managers who typically own only a very small fraction of the shares. In addition, ownership is disperse, that is the corporation is owned by and its profits are distributed among ma

3、ny stockholders.The advantages of the modern corporation are numerous. It relieves financing problems, which enables the firm to assume larger-scale operations and utilize economies of scale. It also facilitates complex-operations allowing the most skilled or expert managers to control business even when they (the professional mangers) do not have enough funds to own the firm. Modern corporations raise money (sell common stocks) in the capital markets and assign it to the productive activities o

4、f professional managers. This is why it is plausible to hypothesize that the modern diverse-ownership corporations perform better than the traditional “closely held” business forms.Moderating factors exist. For example, closely held firms may issue minority shares to raise capital and expand operations. More importantly, modern corporations face a severe new problem called the agency problem: there is a chance that the professional mangers governing the daily operations of the firm would take ac

《股权结构与公司业绩[外文翻译]》由会员cn****1分享,可在线阅读,更多相关《股权结构与公司业绩[外文翻译]》请在金锄头文库上搜索。

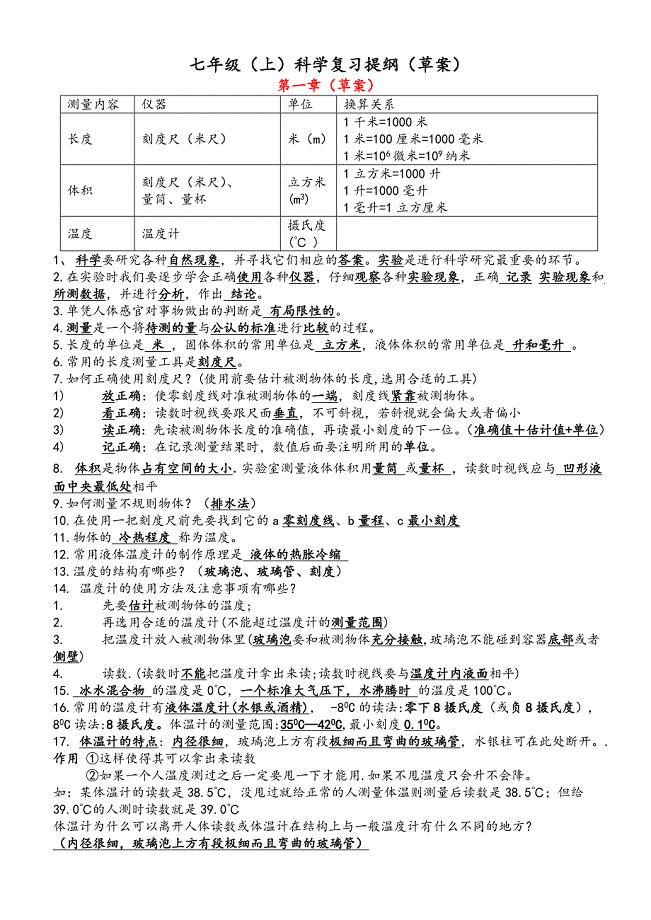

浙教版(新版)七年级科学(上)期中(一至三单元)复习提纲

2022年企业财务管理中所得税税收筹划分析新编.docx

《话剧欣赏与表演》教材.doc

xx市安全生产监督管理局2022工作要点

(完整word版)青年志愿者服务队成立方案.doc

2022年新教师培训总结3篇

bkiAAA级数求和常用方法

级促进经济发展专项资金支持

江山为美人作文1200字.docx

2023年戒毒所民警个人汇报总结范文.doc

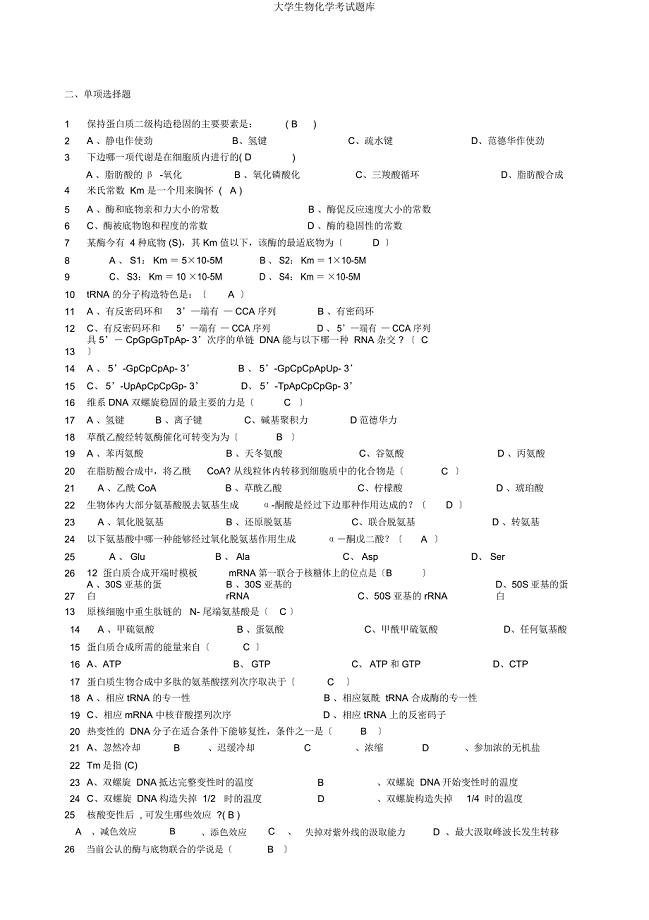

大学生物化学考试题库.docx

2022年初一下册语文期中试卷及答案苏教版.docx

显卡与显示器的认识 (2).doc

公司员工羽毛球比赛详细策划方案.docx

韶关市2013届高三第二次调研考试(语文).doc

同济第六版高等数学教学案WORD版第07章空间解析几何和向量代数

五4第一单元数下

公司承包经营合同格式版(四篇).doc

国内外聚丙烯树脂的生产技术及产品介绍.doc

心因性失眠的矫治.doc

(完整版)整数加减法简便运算练习题(最新整理)

(完整版)整数加减法简便运算练习题(最新整理)

2023-05-05 5页

晚宴流程策划

晚宴流程策划

2023-08-02 5页

疾控中心副主任述职述廉报告

疾控中心副主任述职述廉报告

2024-02-19 5页

防灾减灾从我做起主题班会

防灾减灾从我做起主题班会

2023-06-17 3页

初中老师数学培优补差教学工作总结通用版

初中老师数学培优补差教学工作总结通用版

2023-04-13 6页

《青山不老》说课稿(定稿)

《青山不老》说课稿(定稿)

2022-12-10 4页

三年级下册数学应用题专项练习题100道

三年级下册数学应用题专项练习题100道

2022-12-31 10页

中小学落实“五项管理”2021自查自检报告供借鉴

中小学落实“五项管理”2021自查自检报告供借鉴

2022-12-11 5页

生态农业创业计划项目商业计划书

生态农业创业计划项目商业计划书

2022-11-22 53页

学校一战到底百科知识竞赛策划书.doc

学校一战到底百科知识竞赛策划书.doc

2023-07-31 16页