个人所得税法资料

12页1、第15章 个人所得税法Chapter 15 Individual Income Tax Who are the individuals liable to Individual Income Tax? What is the income from sources within China? What is the income from sources outside China? What income earned by an individual is subject to Individual Income Tax? How to compute the taxable income if the individual income is in foreign currency, in kind and/ or in securities? What does wage, salary income include specifically? How are salaries and wages assessed for Individual Income Tax payab

2、le? How is the “additional deduction for expenses” regulated for wages and salaries? How to compute the income tax payable on the bonus income on the year-end in one payment? How to compute the income tax payable on the income of welfare in kind? How to compute the income tax payable on the income stock options of employees of enterprises? How is severance pay taxed? How to compute the Individual Income Tax payable on the economic compensation received due to termination of labour contract? What

3、 income is included in the production and business operatin income earned by Individual Industrial and Commercial Households? How to calculate the taxable income of individual Industrial and Commercial Households? What are the rules concerning deductions for Individual Industrial and Commercial Households? How to deduct the taxes and industrial and commercial administrative fees paid by Individual Industrial and Commercial Households? How do single proprietorship enterprises compute and pay inco

4、me tax payable on their production and business income? How to levy income tax payable by the investors of single proprietorship and partnership enterprises by mode of administrative assessment? How do single proprietorship and partnership enterprises compute and pay income tax payable on their interest, dividend and bonus income as return from their investment? How is income from contracted or leased operation of enterprises or institutions assessed for Individual Income Tax? How is income from

《个人所得税法资料》由会员鲁**分享,可在线阅读,更多相关《个人所得税法资料》请在金锄头文库上搜索。

![一元稀疏多项式计算器实习报告[1]](https://union.152files.goldhoe.com/2022-11/4/c957d1e0-ee78-4718-a7d1-211ac9134898/pic1.jpg)

一元稀疏多项式计算器实习报告[1]

必备护士述职报告范文集锦9篇

VK1024B 2.4V~5.2V 6SEG&amp#215;4COM点阵.docx

男生给女生的道歉信

2023年交通安全发言稿(完整文档)

在校学生顶岗实习总结报告(二篇).doc

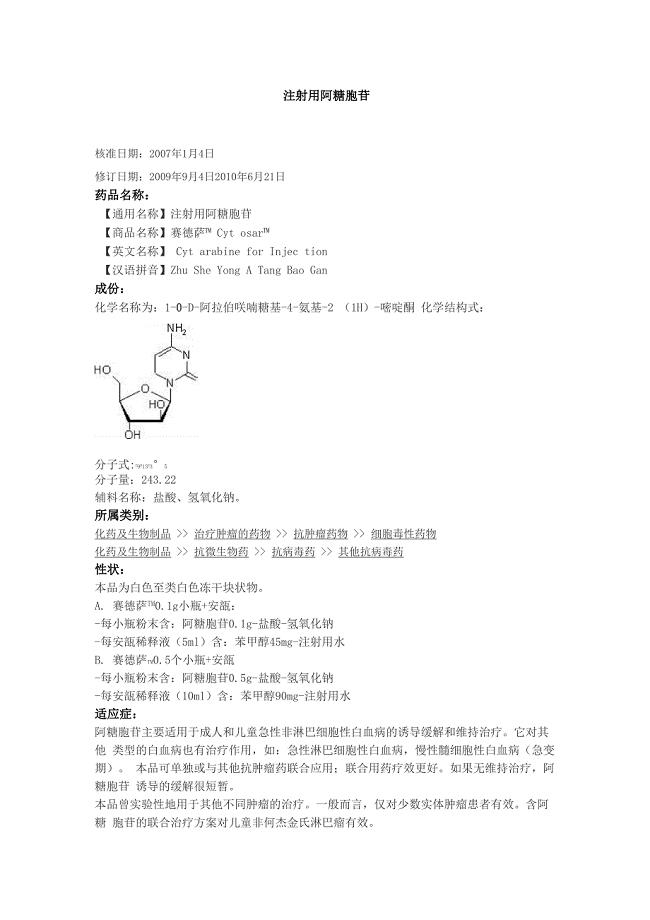

注射用阿糖胞苷

物资管理办法38459315

多一些专业的安全工程人才

教师作风个人年度工作总结(5篇).doc

骆驼祥子读后感15篇2

2022年四川省建筑安管人员ABC类证书【官方】资格证书资格考核试题附参考答案60

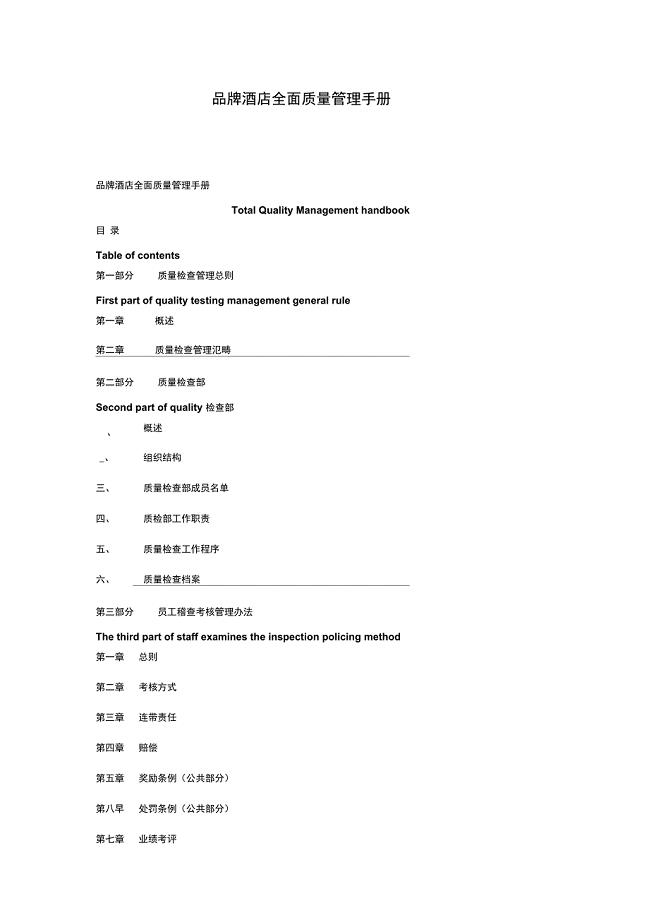

品牌酒店全面质量管理手册

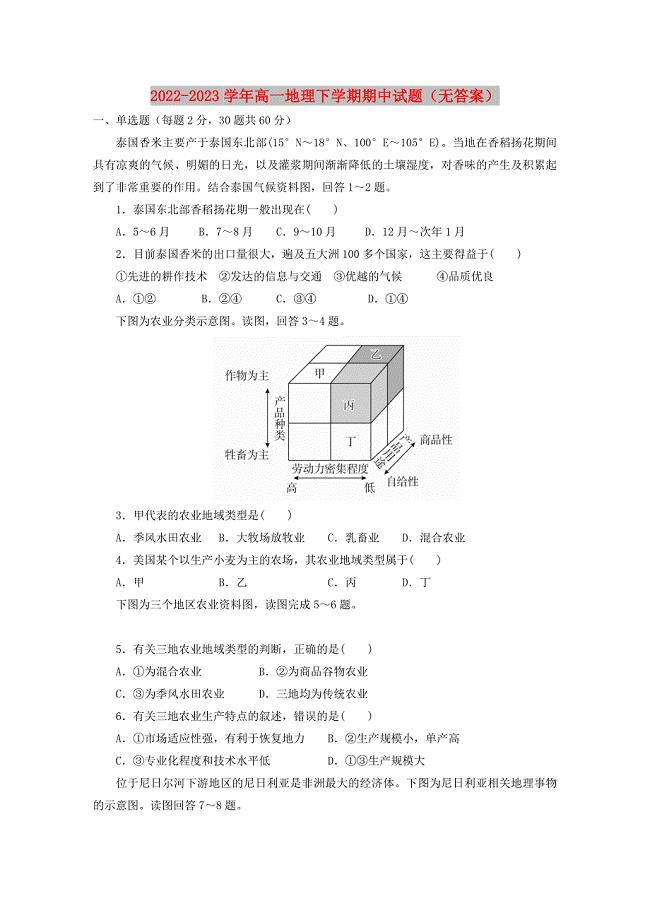

2022-2023学年高一地理下学期期中试题(无答案)

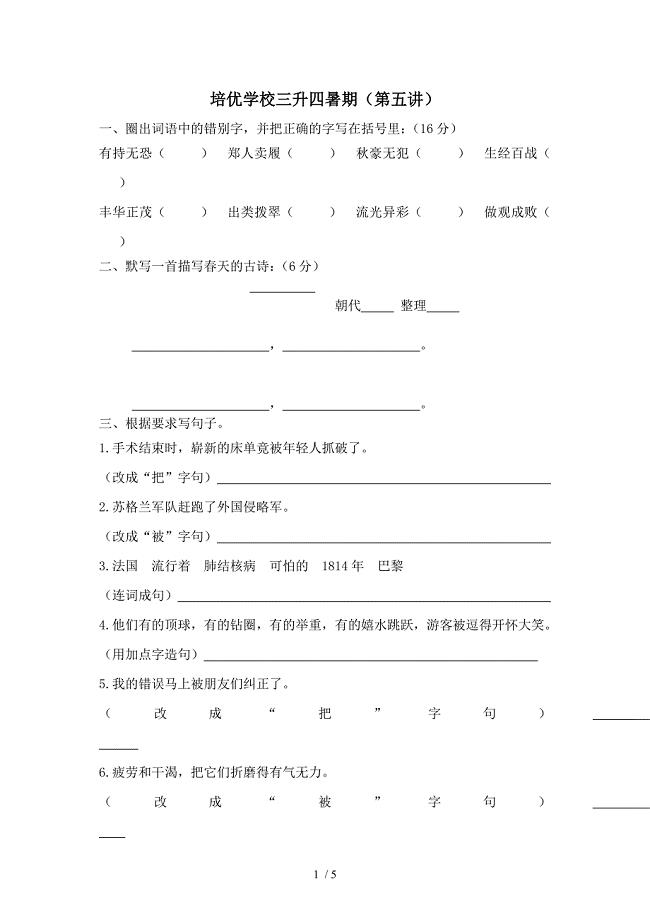

人教版三升四语文五

it行业面试自我介绍版

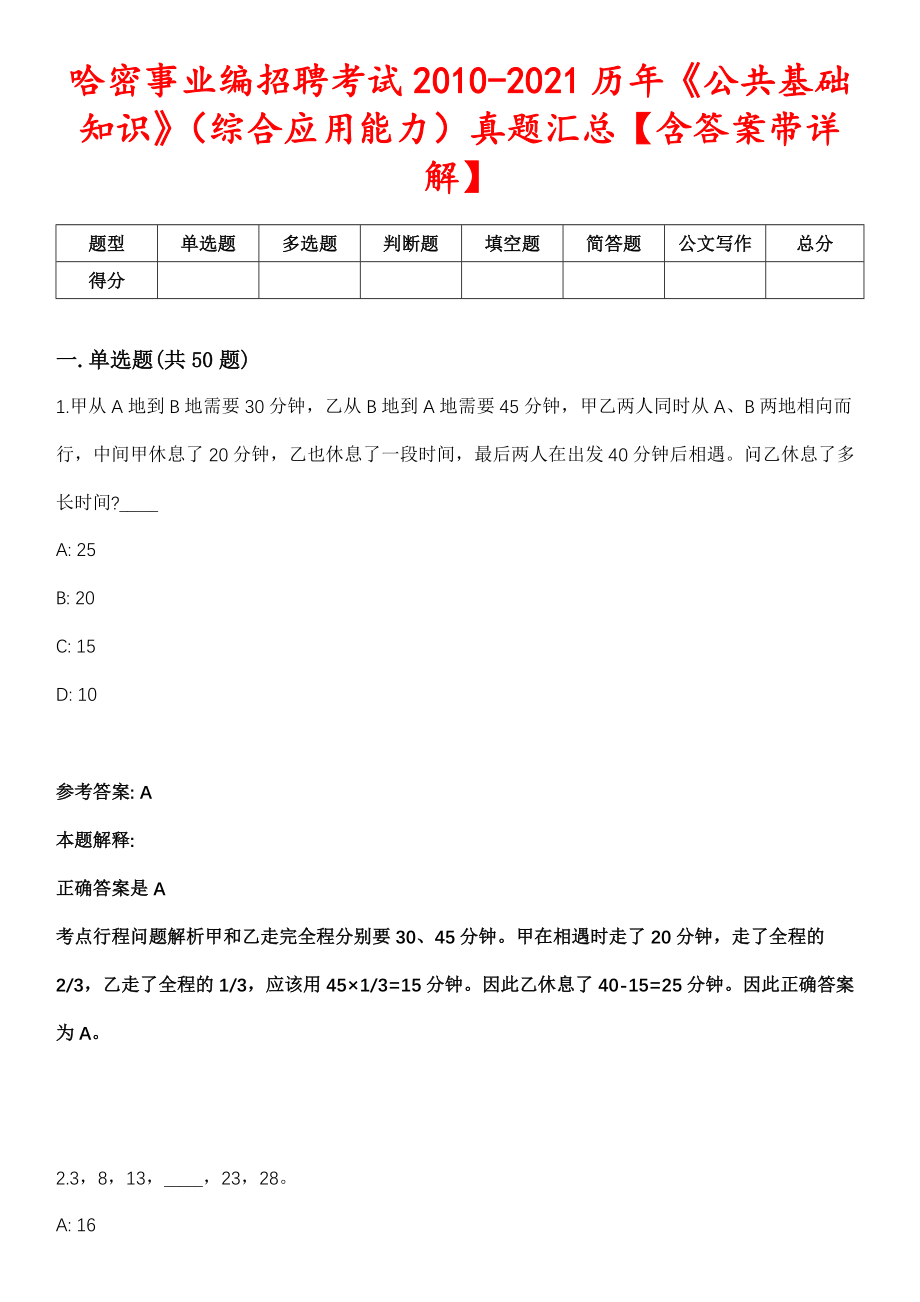

哈密事业编招聘考试2010-2021历年《公共基础知识》(综合应用能力)真题汇总【含答案带详解】

下黄村村级供水工程小额工程施工

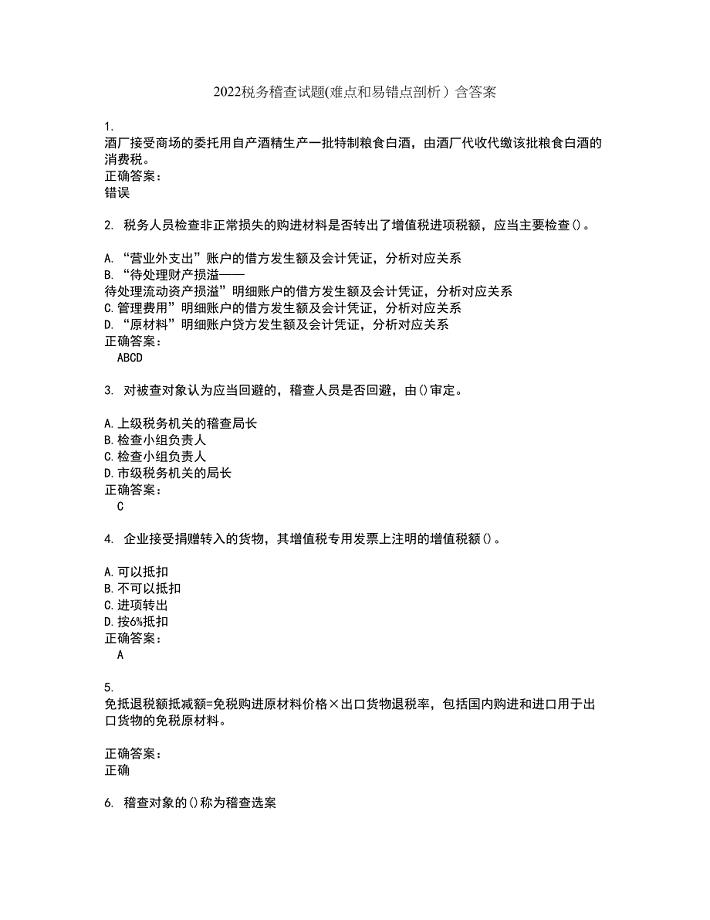

2022税务稽查试题(难点和易错点剖析)含答案53

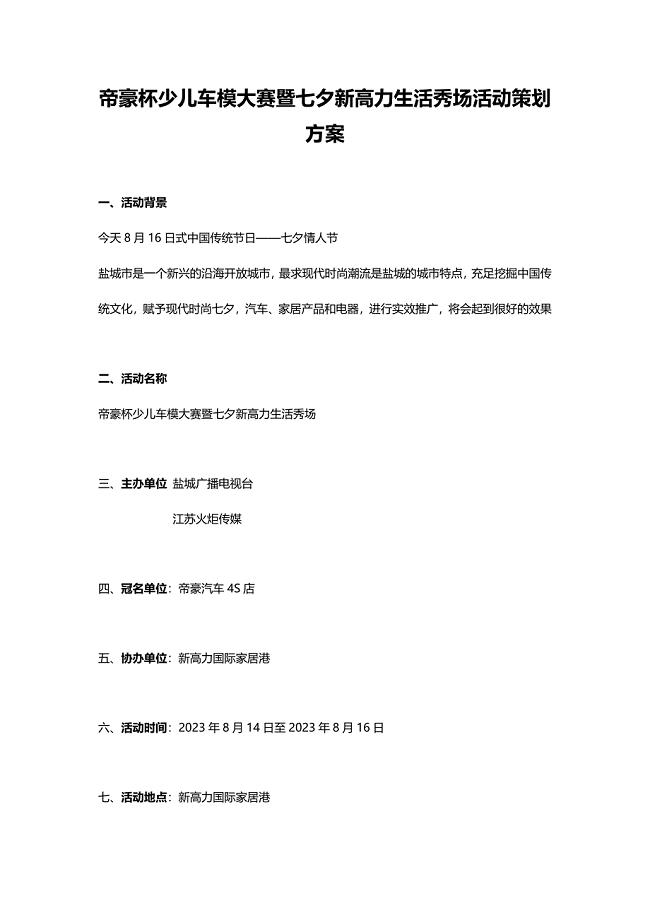

帝豪杯少儿车模大赛暨七夕新高力生活秀场活动策划方案

疫苗生产工艺流程图

疫苗生产工艺流程图

2023-10-13 3页

某科技开发有限公司研发项目管理制度

某科技开发有限公司研发项目管理制度

2023-12-05 223页

俏新娘的婚纱照攻略

俏新娘的婚纱照攻略

2023-12-31 4页

教师清廉家风故事征文

教师清廉家风故事征文

2024-02-24 3页

施工现场安全生产事故应急救援预案

施工现场安全生产事故应急救援预案

2024-02-20 14页

中考数学一轮复习-专题练习2-方程组与不等式-浙教版

中考数学一轮复习-专题练习2-方程组与不等式-浙教版

2023-06-21 15页

公司开业庆典活动方案

公司开业庆典活动方案

2022-08-23 18页

普通货代业务指定货操作流程

普通货代业务指定货操作流程

2023-03-06 19页

安全及防火施工方案

安全及防火施工方案

2022-08-08 19页

![一元稀疏多项式计算器实习报告[1]](/Images/s.gif) 一元稀疏多项式计算器实习报告[1]

一元稀疏多项式计算器实习报告[1]

2022-11-20 10页