财务报表分析外文文献及翻译

17页1、Review of accounting studies,2003,16(8):531-560Financial Statement Analysis of Leverage and How It Informs About Protability and Price-to-Book RatiosDoron Nissim, Stephen. PenmanAbstractThis paper presents a nancial statement analysis that distinguishes leverage that arises in nancing activities from leverage that arises in operations. The analysis yields two leveraging equations, one for borrowing to nance operations and one for borrowing in the course of operations. These leveraging equations

2、describe how the two types of leverage affect book rates of return on equity. An empirical analysis shows that the nancial statement analysis explains cross-sectional differences in current and future rates of return as well as price-to-book ratios, which are based on expected rates of return on equity. The paper therefore concludes that balance sheet line items for operating liabilities are priced differently than those dealing with nancing liabilities. Accordingly, nancial statement analysis t

3、hat distinguishes the two types of liabilities informs on future protability and aids in the evaluation of appropriate price-to-book ratios.Keywords: financing leverage; operating liability leverage; rate of return on equity; price-to-book ratioLeverage is traditionally viewed as arising from nancing activities: Firms borrow to raise cash for operations. This paper shows that, for the purposes of analyzing protability and valuing rms, two types of leverage are relevant, one indeed arising from n

4、ancing activities but another from operating activities. The paper supplies a nancial statement analysis of the two types of leverage that explains differences in shareholder protability and price-to-book ratios.The standard measure of leverage is total liabilities to equity. However, while some liabilitieslike bank loans and bonds issuedare due to nancing, other liabilitieslike trade payables, deferred revenues, and pension liabilitiesresult from transactions with suppliers, customers and emplo

《财务报表分析外文文献及翻译》由会员ni****g分享,可在线阅读,更多相关《财务报表分析外文文献及翻译》请在金锄头文库上搜索。

(完整版)湘教版三年级下册美术教学计划.doc

落花生第二课时教学设计.doc

班主任与家长沟通的技巧

米跨箱梁满堂支架施工方案

人教版八年级英语下册《Unit9语法学法指导》导学案设计(含).doc

松原胰岛素注射器械项目申请报告【参考范文】

学校幼师个人转正工作总结3篇.docx

销售个人目标工作计划模板(三篇).doc

SAP BW配置及操作手册(BW中文图文教程)

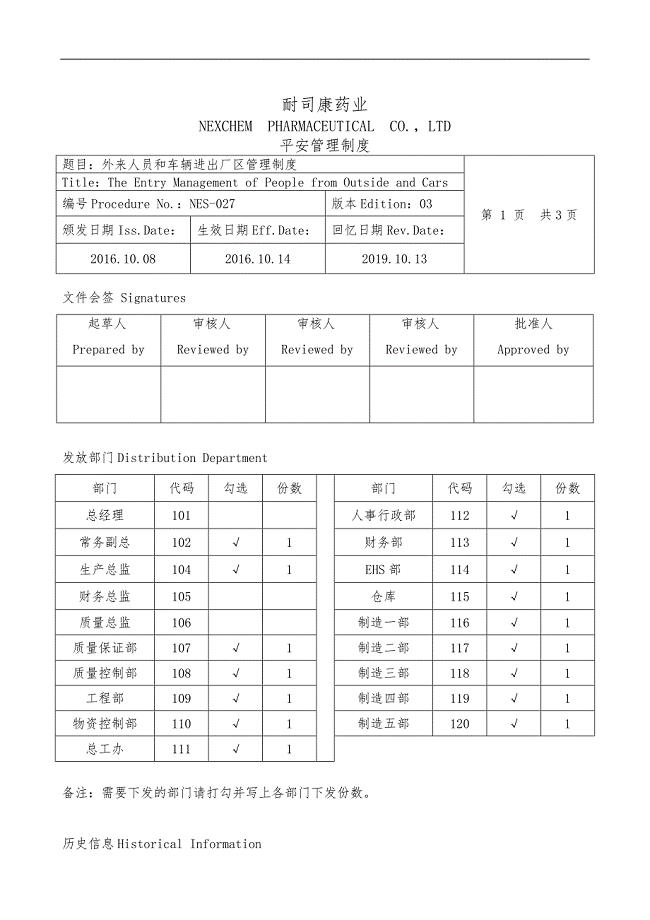

外来人员和车辆进出厂区管理制度

会计年终个人工作总结范文四.doc

传统节日端午节国旗下优秀演讲稿最新5篇精选.doc

正式的抵押借款合同

2019年春季学期月教学工作安排.docx

我们要勤俭节约

2023年班主任导师育人个人工作计划合集

2023年广东深圳职业技术学院招考聘用136人笔试参考题库附答案详解

浅析新课改下初中数学教学的反思及对策.doc

安阳市二手房交易协议标准模板(四篇).doc

学校学生食堂管理制度汇编(DOC 35页)

固定单价施工合同

固定单价施工合同

2023-04-16 9页

直升机飞行原理

直升机飞行原理

2023-02-21 6页

2019年河北省中考数学模拟试题(三)含详细答案精选

2019年河北省中考数学模拟试题(三)含详细答案精选

2022-08-04 12页

电子标签系统解决方案样本.doc

电子标签系统解决方案样本.doc

2023-04-03 5页

吉林大学21春《病理解剖学》在线作业二满分答案37

吉林大学21春《病理解剖学》在线作业二满分答案37

2024-01-13 14页

村基层干部科技素质培训专题计划.doc

村基层干部科技素质培训专题计划.doc

2022-11-08 6页

图书馆工读管理自动化与服务人力的全人发展(DOC 31页)

图书馆工读管理自动化与服务人力的全人发展(DOC 31页)

2023-11-26 29页

南开大学21春《税收理论与实务》离线作业一辅导答案29

南开大学21春《税收理论与实务》离线作业一辅导答案29

2023-01-05 13页

江西省机械电子技工学校学生公寓管理制度.docx

江西省机械电子技工学校学生公寓管理制度.docx

2023-03-05 5页

口腔门诊前台工作细则.doc

口腔门诊前台工作细则.doc

2022-10-04 20页