the new arsenal of risk management

12页1、The New Arsenal of Risk ManagementHarvard Business Review; Sep2008, Vol. 86 Issue 9, p92-100By Kevin Buehler; Andrew Freeman and Ron HulmeAbstract:The global banking system is facing a severe liquidity crisis: In the first half of 2008, major financial institutions wrote off nearly $400 billion, causing banks around the world to initiate emergency measures. Similar crises have occurred within recent memory: Think of S&Ls, the dot-com bust, and Enron. Risk is, quite simply, a fact of corporate li

2、fe-but because risk-management research has increasingly emphasized mathematical modeling, managers may find it incomprehensible and thus shy away from powerful tools and markets for creating value. Buehler, Freeman, and Hulme, all with McKinsey, describe the evolution of risk management since the 1970s, show how new markets have changed the landscape in both financial services and the energy sector, and explain what it takes to compete in the current environment. To demonstrate how significant

3、a factor risk can be when incorporated into strategy and organization, they take the case of Goldman Sachs - which, despite its reliance on highly volatile trading revenues, has so far avoided the big write-offs that have afflicted its leading competitors. The authors believe that this is because Goldman takes the antithesis of the typical corporate approach-its culture embraces rather than avoids risk. And, they say, Goldman very efficiently employs all four of the following factors: quantitati

4、ve professionals, strong oversight, partnership investment, and a clear statement of business principles, with emphasis on preserving the companys reputation. Staying on the sidelines of risk management may have shielded some companies from crisis, but it has also prevented them from growing as quickly as they might have. In their companion article, Owning the Right Risks, the authors outline a process that will enable executives in any company to incorporate risk into their strategic decision m

《the new arsenal of risk management》由会员小**分享,可在线阅读,更多相关《the new arsenal of risk management》请在金锄头文库上搜索。

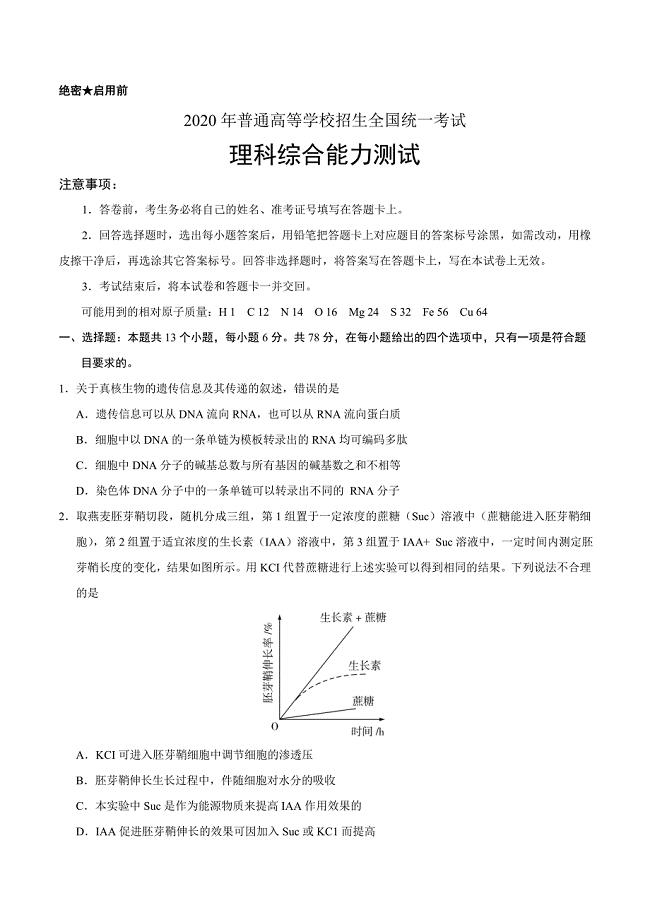

2020年高考真题——理科综合(全国卷Ⅲ)+Word版含答案

2021年绝味鸭脖策划书

2021年熟食店创业方案

2021年熟食店开店策划

2021年卤菜店创业计划书

2021年周黑鸭网络营销策划方案

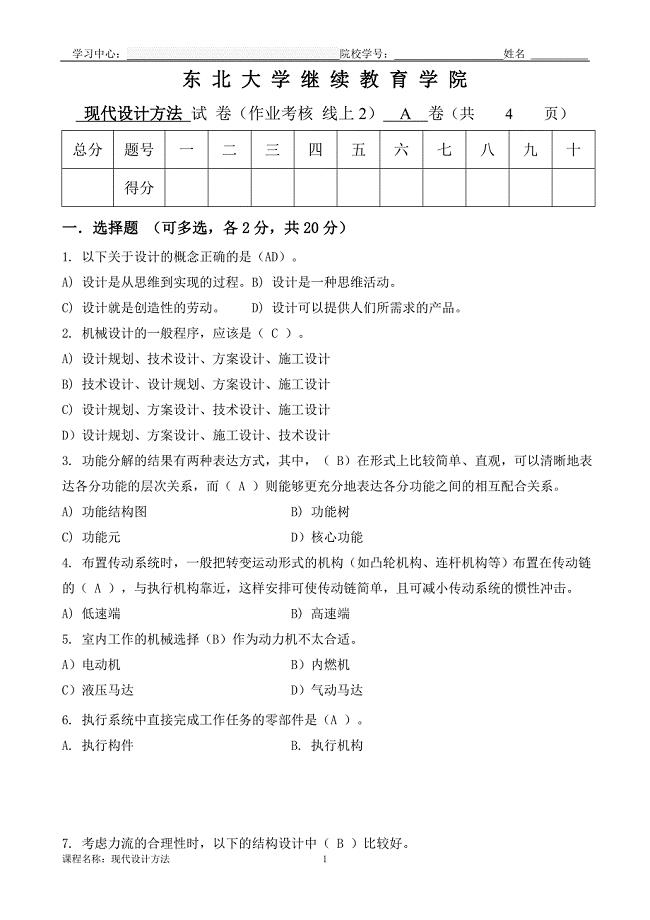

东大21年1月考试《现代设计方法》考核作业

谈我国行政管理效率的现状及其改观对策(论文)

单证员考试-备考辅导-复习资料:无贸易背景信用证案分析.docx

土木工程毕业生答辩自述.docx

建筑学毕业后工作状态真实写照.doc

C#代码规范(湖南大学).doc

xx区食药监局2019年工作总结及2020年工作计划

2019年中医院药物维持治疗门诊工人先锋号先进事迹

2019年度xx乡镇林长制工作总结

2019年性艾科工作计划书

2019年人才服务局全国扶贫日活动开展情况总结

关于组工信息选题的几点思考

摘了穷帽子 有了新模样

2019年某集团公司基层党支部书记培训班心得体会

09.石油公司制度体系诊断及优化咨询项目

09.石油公司制度体系诊断及优化咨询项目

2024-04-08 33页

职工教育培训经费管理办法(规模生产制造业版)

职工教育培训经费管理办法(规模生产制造业版)

2024-04-08 10页

08.圆通银行战略咨询项目

08.圆通银行战略咨询项目

2024-04-08 25页

企业培训费管理实施暂行细则

企业培训费管理实施暂行细则

2024-04-08 12页

职工教育培训经费管理办法(适合中小企业)

职工教育培训经费管理办法(适合中小企业)

2024-04-08 10页

企业规章制度框架体系管理规定(2024修订版)

企业规章制度框架体系管理规定(2024修订版)

2024-04-08 21页

05.景宏集团全面管理提升咨询项目

05.景宏集团全面管理提升咨询项目

2024-04-08 40页

07.玉兔食品集团供应链咨询项目

07.玉兔食品集团供应链咨询项目

2024-04-08 34页

04.大华乳业业务战略咨询项目

04.大华乳业业务战略咨询项目

2024-04-08 28页

06.德邦公司精益生产管理咨询项目

06.德邦公司精益生产管理咨询项目

2024-04-08 28页