公司理财(英文版)题库3

24页1、CHAPTER 3Financial Statement Analysis, Planning, and GrowthMultiple Choice Questions:I.DEFINITIONSLONG-TERM PLANNINGc1.One key reason a long-term financial plan is developed is because:a.the plan determines your financial policy. b.the plan determines your investment policy. c.there are direct connections between achievable corporate growth and the financial policy. d.there is unlimited growth possible in a well-developed financial plan. e.None of the above. PRO FORMA STATEMENTSb2.Projected futu

2、re financial statements are called:a.plug statements. b.pro forma statements. c.reconciled statements. d.aggregated statements. e.none of the above.PERCENTAGE OF SALESe3.The percentage of sales method: a.requires that all accounts grow at the same rate. b.separates accounts that vary with sales and those that do not vary with sales. c.allows the analyst to calculate how much financing the firm will need to support the predicted sales level. d.Both A and B. e.Both B and C. COMMON-SIZE STATEMENTSe

3、4.A _ standardizes items on the income statement and balance sheet as a percentage of total sales and total assets, respectively.a.tax reconciliation statementb.statement of standardizationc.statement of cash mon-base year mon-size statementFINANCIAL RATIOSa5.Relationships determined from a firms financial information and used for comparison purposes are known as:a.financial parison statements.c.dimensional analysis.d.scenario analysis.e.solvency analysis.SHORT-TERM SOLVENCY RATIOSc6.Financial r

4、atios that measure a firms ability to pay its bills over the short run without undue stress are known as _ ratios.a.asset managementb.long-term solvencyc.short-term solvencyd.profitabilitye.market valueCURRENT RATIOb7.The current ratio is measured as:a.current assets minus current liabilities.b.current assets divided by current liabilities.c.current liabilities minus inventory, divided by current assets.d.cash on hand divided by current liabilities.e.current liabilities divided by current assets

《公司理财(英文版)题库3》由会员油条分享,可在线阅读,更多相关《公司理财(英文版)题库3》请在金锄头文库上搜索。

最新学校新冠肺炎疫情突发事件应急处置办法和流程

最新疫情防控期间学校用餐与食堂管理规定和师生一日流程图

最新Xx省xx区返学师生员工健康登记表

诊所简介

高中英语-第二单元-《the-United-Kingdom》课件-新必修5

新版新目标英语七年级下unit4--Don't-eat-in-class课件

新版PEP六年级英语unit6-how-do-you-feel-A-Let's-talk

安徽专版2018秋八年级英语上册Unit5Doyouwanttowatchagameshow第6课时习题课件新人教目标版

酸的和甜的教学课件.doc

Lesson-1-Where-do-we-go-from-here概要

Docker技术与实践

七年级英语下册-Unit-9-What-does-he-look-like(第3课时)(Grammar-Focus-3d)同步语法精讲精练课件-(新版

《I'm-going-to-do-the-high-jump》PPT课件3

高二英语外研版-必修5-Module-2-A-Job-Worth-Doing-Reading课件

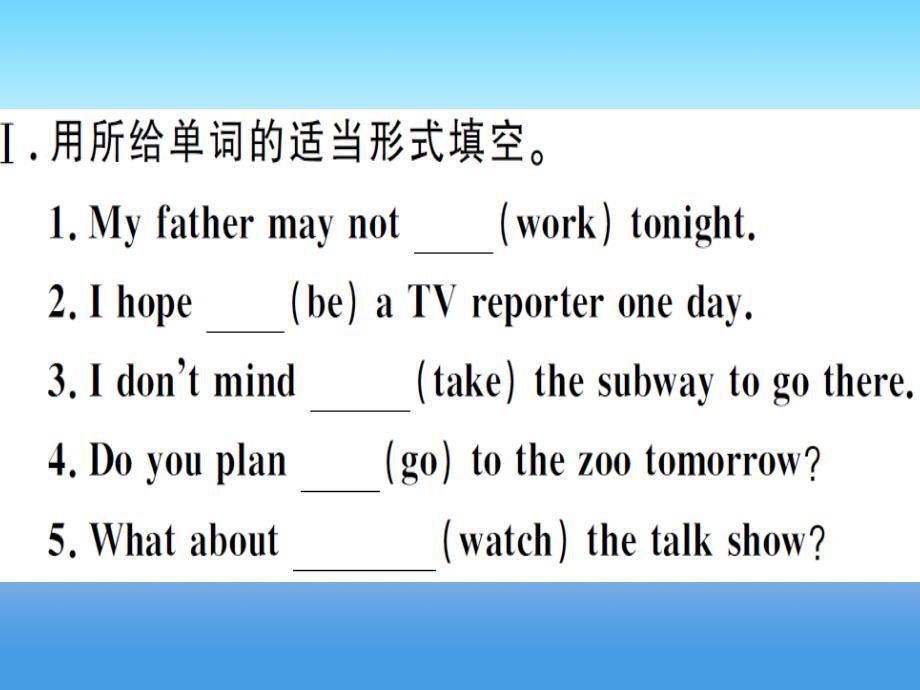

英语片段教学-I-can-do-it

Adobe公司简介

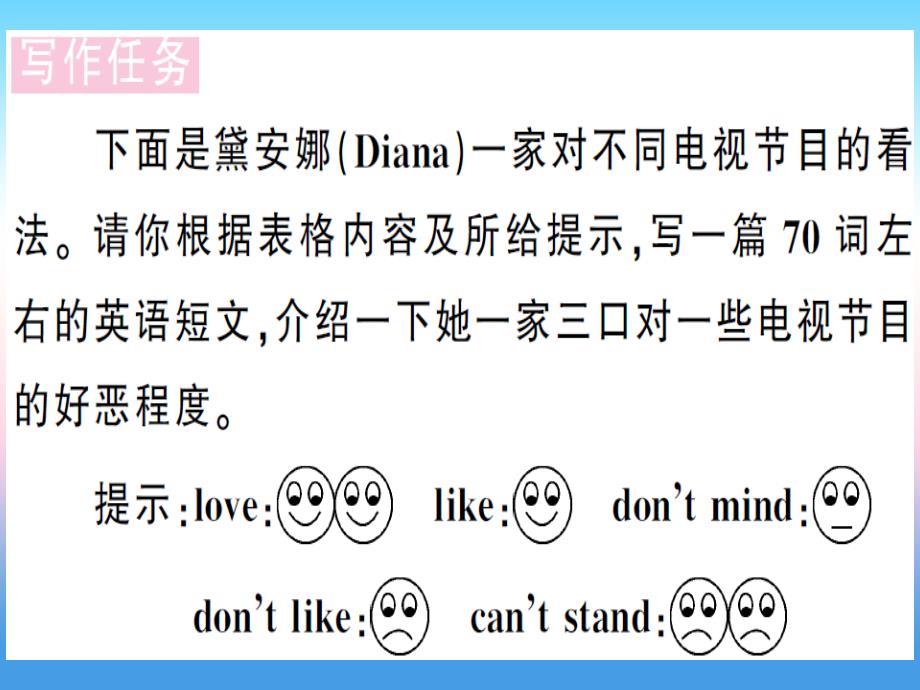

安徽专版2018秋八年级英语上册Unit5Doyouwanttowatchagameshow第2课时习题课件新人教目标版

第二单元全课件Unit2-What-time-do-you-go-to-school-全课件

第18课-Windows的磁盘管理与安全

第12章--Windows-Server-2008路由及远程访问

2024年安徽省芜湖市中考二模语文试卷【含答案】

2024年安徽省芜湖市中考二模语文试卷【含答案】

2024-04-24 10页

2024届河北省邯郸市中考一模语文试题【含答案】

2024届河北省邯郸市中考一模语文试题【含答案】

2024-04-24 10页

2024年(6月份)中考数学押题试卷【含答案】

2024年(6月份)中考数学押题试卷【含答案】

2024-04-24 25页

2024年江苏省扬州市宝应县中考一模语文试题【含答案】

2024年江苏省扬州市宝应县中考一模语文试题【含答案】

2024-04-24 10页

辽宁省本溪市2022-2023学年高中下学期学业水平考试美术试题【含答案】

辽宁省本溪市2022-2023学年高中下学期学业水平考试美术试题【含答案】

2024-04-23 4页

第六单元 正比例和反比例 (单元测试卷)苏教版数学六年级下册【含答案】

第六单元 正比例和反比例 (单元测试卷)苏教版数学六年级下册【含答案】

2024-04-23 10页

江苏省无锡市2024年七年级下学期期中数学调研试卷【含答案】

江苏省无锡市2024年七年级下学期期中数学调研试卷【含答案】

2024-04-23 19页

江苏省江阴市华士片2022-2023学年七年级下学期期中语文试题【含答案】

江苏省江阴市华士片2022-2023学年七年级下学期期中语文试题【含答案】

2024-04-23 10页

江苏省泰州兴化市2023-2024学年高一下学期期中考试语文试题【含答案】

江苏省泰州兴化市2023-2024学年高一下学期期中考试语文试题【含答案】

2024-04-23 16页

小学六年级体育与健康测试题【含答案】

小学六年级体育与健康测试题【含答案】

2024-04-23 5页

广东省建筑装饰工程竣工验收技术资料统一用表

广东省建筑装饰工程竣工验收技术资料统一用表 水基防锈剂配方组成比例,防锈原理及配制方法

水基防锈剂配方组成比例,防锈原理及配制方法 辩论赛宁要大城市一张床,宁要小城镇一间房

辩论赛宁要大城市一张床,宁要小城镇一间房 【2018年整理】动力气象吕美仲课后答案.pdf

【2018年整理】动力气象吕美仲课后答案.pdf 红楼梦后28回(癸酉本)

红楼梦后28回(癸酉本) 金锄头网企业认证授权书(负责人非法人必须提供)

金锄头网企业认证授权书(负责人非法人必须提供) 服装设计助理实习周记

服装设计助理实习周记 制造机械项目投资分析报告(总投资15000万元)(78亩)

制造机械项目投资分析报告(总投资15000万元)(78亩) 计算机网络技术基础 教学课件 作者 阚宝朋 课件 第2章 网络体系结构与网络协议

计算机网络技术基础 教学课件 作者 阚宝朋 课件 第2章 网络体系结构与网络协议 计算机网络技术基础 教学课件 作者 阚宝朋 课件 第5章 网络层与网络互联

计算机网络技术基础 教学课件 作者 阚宝朋 课件 第5章 网络层与网络互联 计算机网络技术基础 教学课件 作者 阚宝朋 课件 第1章 网络基础知识

计算机网络技术基础 教学课件 作者 阚宝朋 课件 第1章 网络基础知识 输煤管道生产建设项目可行性研究报告

输煤管道生产建设项目可行性研究报告